Government Initiatives and Funding

Government support plays a crucial role in the development of the smart healthcare market in Italy. Initiatives aimed at promoting digital health solutions are gaining momentum, with the Italian government allocating substantial funds to enhance healthcare infrastructure. In 2025, it is estimated that public funding for smart healthcare initiatives will reach €1.5 billion, aimed at improving healthcare accessibility and efficiency. This financial backing is likely to encourage private sector investment and foster innovation within the market. Additionally, regulatory frameworks are being established to facilitate the adoption of smart technologies, ensuring that healthcare providers can implement these solutions effectively. Such government initiatives not only stimulate market growth but also enhance the overall quality of healthcare services available to the Italian population.

Integration of Health Data Systems

The integration of health data systems is a vital driver for the smart healthcare market in Italy. As healthcare providers increasingly recognize the importance of data interoperability, efforts to streamline health information exchange are intensifying. In 2025, it is anticipated that over 70% of healthcare organizations in Italy will adopt integrated health information systems, facilitating better communication and collaboration among providers. This integration allows for comprehensive patient data access, leading to improved decision-making and care coordination. Moreover, the ability to analyze large datasets can enhance public health initiatives and research efforts. As the smart healthcare market continues to evolve, the emphasis on data integration will likely play a crucial role in enhancing the efficiency and effectiveness of healthcare delivery in Italy.

Aging Population and Chronic Diseases

Italy's demographic trends significantly influence the smart healthcare market. With a rapidly aging population, the demand for healthcare services is increasing, particularly for chronic disease management. By 2025, it is projected that over 30% of the Italian population will be aged 65 and older, leading to a higher prevalence of age-related health issues. This demographic shift necessitates the adoption of smart healthcare solutions to manage chronic conditions effectively. Technologies such as remote monitoring and telehealth services are becoming essential in providing continuous care and reducing hospital visits. The smart healthcare market is likely to expand as healthcare providers seek innovative ways to address the challenges posed by an aging population, ultimately improving patient care and reducing healthcare costs.

Technological Advancements in Healthcare

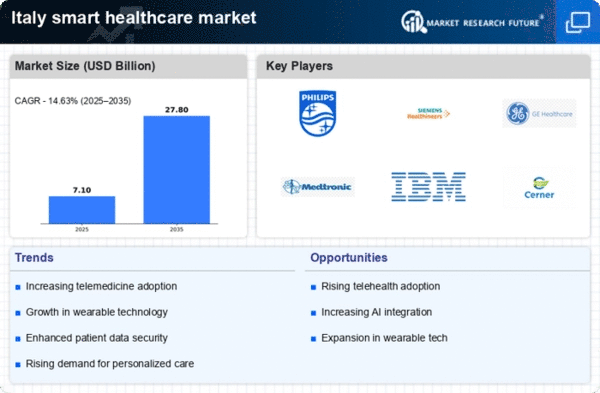

The rapid evolution of technology is a primary driver for the smart healthcare market in Italy. Innovations such as artificial intelligence, machine learning, and the Internet of Things (IoT) are transforming healthcare delivery. These technologies enable real-time patient monitoring, predictive analytics, and personalized treatment plans. In 2025, the Italian healthcare sector is projected to invest approximately €2 billion in digital health technologies, reflecting a growing commitment to integrating smart solutions. This investment is likely to enhance operational efficiency and improve patient outcomes, thereby propelling the smart healthcare market forward. Furthermore, the increasing demand for telehealth services and remote patient monitoring solutions indicates a shift towards more accessible healthcare, which is essential for the evolving needs of the population.

Consumer Demand for Personalized Healthcare

There is a growing consumer demand for personalized healthcare solutions in Italy, which is driving the smart healthcare market. Patients are increasingly seeking tailored treatment options that cater to their individual health needs and preferences. This trend is reflected in the rising popularity of wearable health devices and mobile health applications that allow users to track their health metrics. In 2025, it is estimated that the market for wearable health technology in Italy will exceed €1 billion, indicating a strong consumer interest in proactive health management. As healthcare providers respond to this demand by integrating smart technologies into their services, the smart healthcare market is expected to flourish. This shift towards personalization not only enhances patient engagement but also improves health outcomes, making it a pivotal driver in the market.