Rising Demand in Cosmetics

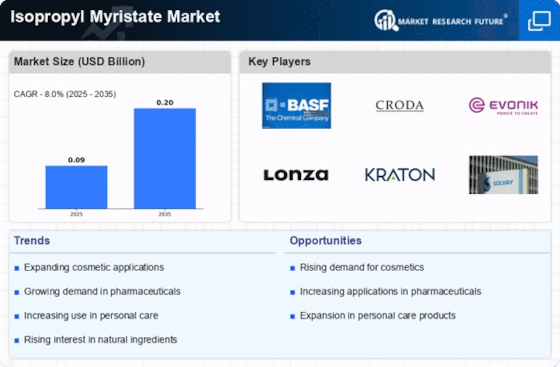

The Isopropyl Myristate Market is experiencing a notable surge in demand, particularly within the cosmetics sector. This compound is widely utilized as an emollient and solvent, enhancing the texture and absorption of various cosmetic formulations. As consumers increasingly seek products that offer a luxurious feel and effective moisture retention, the incorporation of Isopropyl Myristate Market becomes essential. Market data indicates that the cosmetics segment is projected to grow at a compound annual growth rate (CAGR) of approximately 5% over the next five years. This growth is driven by the rising popularity of skincare and makeup products that prioritize skin health and aesthetics, thereby solidifying Isopropyl Myristate Market's role in the evolving landscape of cosmetic formulations.

Pharmaceutical Industry Growth

The Isopropyl Myristate Market is significantly influenced by the expanding pharmaceutical sector. This compound is recognized for its ability to enhance drug solubility and bioavailability, making it a valuable ingredient in various topical formulations. The increasing prevalence of chronic diseases and the subsequent demand for effective therapeutic solutions are propelling the growth of this market. Recent data suggests that the pharmaceutical segment utilizing Isopropyl Myristate Market is expected to witness a CAGR of around 4% in the coming years. This trend underscores the compound's importance in improving the efficacy of medications, particularly in transdermal delivery systems, thereby reinforcing its position within the pharmaceutical landscape.

Shift Towards Sustainable Ingredients

The Isopropyl Myristate Market is increasingly influenced by the shift towards sustainable and eco-friendly ingredients. Consumers are becoming more aware of the environmental impact of their purchases, leading to a demand for products that are not only effective but also sustainably sourced. Isopropyl Myristate Market, derived from natural sources, aligns with this trend, making it an attractive option for manufacturers aiming to meet consumer expectations. Market trends suggest that the demand for sustainable ingredients in personal care and cosmetics is expected to grow at a CAGR of approximately 5% over the next few years. This shift presents an opportunity for Isopropyl Myristate Market to establish itself as a key player in the sustainable ingredient market.

Surge in Demand for Anti-Aging Products

The Isopropyl Myristate Market is witnessing a marked increase in demand for anti-aging products. As the global population ages, there is a growing consumer focus on skincare solutions that address signs of aging, such as wrinkles and fine lines. Isopropyl Myristate Market serves as an effective carrier for active ingredients in these formulations, enhancing their penetration and overall effectiveness. Market analysis indicates that the anti-aging skincare segment is projected to grow at a CAGR of approximately 6% over the next several years. This trend highlights the compound's critical role in the formulation of innovative anti-aging products, thereby driving its demand within the skincare industry.

Regulatory Support for Cosmetic Ingredients

The Isopropyl Myristate Market benefits from increasing regulatory support for cosmetic ingredients. Regulatory bodies are progressively endorsing the use of safe and effective compounds in personal care products, which includes Isopropyl Myristate Market. This support not only fosters consumer confidence but also encourages manufacturers to incorporate this ingredient into their formulations. As a result, the market for Isopropyl Myristate Market is likely to expand, with projections indicating a steady growth rate of around 3% in the coming years. This regulatory environment is conducive to innovation and the development of new products, further solidifying Isopropyl Myristate Market's position in the cosmetics and personal care sectors.