Top Industry Leaders in the Isobutyric Acid Market

Isobutyric acid, a versatile organic compound with diverse applications, finds its way into industries like food and flavors, pharmaceuticals, animal feed, and chemicals. The global market for this crucial ingredient is driven by rising demand across these sectors. But within this promising landscape lies a competitive arena where players vie for market share and influence.

Strategies Adopted by Market Leaders:

-

Diversification: Leading players are expanding their product portfolios to cater to various purity grades (reagent, industrial) and applications (food, pharmaceuticals). This diversification mitigates risk and attracts a broader customer base. -

Geographical Expansion: Established players are venturing into emerging markets like China, India, and Southeast Asia, driven by the increasing demand from these regions' burgeoning food and pharmaceutical industries. -

Technological Advancements: Companies are investing in research and development to optimize production processes, improve efficiency, and create sustainable bio-based isobutyric acid alternatives. This focus on innovation allows them to stay ahead of the curve and cater to environmentally conscious consumers. -

Vertical Integration: Some players are integrating backward by acquiring raw material sources or forward by establishing their own distribution channels. This vertical integration provides greater control over the supply chain and improves profit margins. -

Strategic Partnerships and Acquisitions: Collaborations with other companies in the value chain, such as chemical distributors or downstream applications manufacturers, are becoming increasingly common. Additionally, acquisitions of smaller players with niche expertise or regional reach are also a strategic move to gain market share.

Factors Influencing Market Share:

-

Production Capacity and Cost: Companies with efficient and cost-effective production processes hold a competitive edge. Access to low-cost raw materials and advanced technologies play a crucial role in determining cost leadership. -

Product Quality and Regulatory Compliance: Meeting stringent quality standards and regulations, particularly in the food and pharmaceutical industries, is essential for market share. Stringent certifications like GMP and ISO add value to a company's offerings. -

Brand Recognition and Customer Relationships: Building a strong brand reputation and establishing long-term relationships with customers fosters trust and loyalty, securing repeat business and market share. -

Distribution Network and Logistics: Efficient and widespread distribution networks ensure timely delivery and accessibility to customers, giving an edge to companies with well-established channels. -

Research and Development: Continuous innovation in production methods, product development, and sustainable alternatives attracts customers and creates future market opportunities.

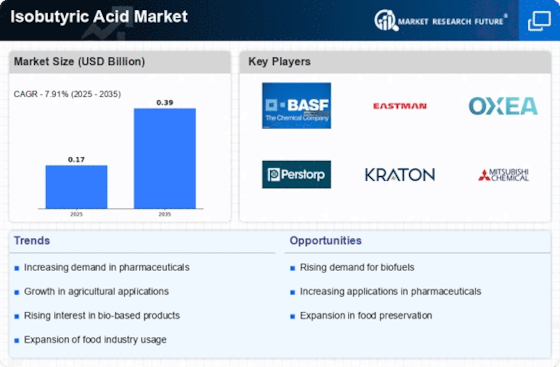

Key Companies in the Isobutyric Acid market include

- Beijing Huamaoyuan Fragrance Flavor Co., ltd., Inc. (China)

- Perstorp Holding AB(Germany)

- OXEA GmbH (Germany)

- Blue Marble Biomaterials(U.S.)

- Tokyo Chemical Industry Co. Ltd.(Japan)

- Snowco industrial Co., Ltd. (China)

- Eastman Chemical Company(U.S.)

Recent Developments:

September 2023: Evonik Industries announced a partnership with a Chinese company to establish a joint venture for producing isobutyric acid in China. This strategic move aims to capitalize on the growing demand in the Asian market.

October 2023: The US Food and Drug Administration (FDA) approved a new pharmaceutical product containing isobutyric acid for the treatment of a rare neurological disorder. This approval is expected to boost demand for the acid in the pharmaceutical sector.

November 2023: A research paper published in a prestigious scientific journal highlighted the potential of using isobutyric acid in the production of bioplastics. This development could open new market opportunities for the acid in the future.

December 2023: The global price of isobutyric acid experienced a slight increase due to disruptions in the supply chain caused by extreme weather events in major production regions.