Increased Awareness and Education

There is a growing awareness and understanding of Islamic finance principles among consumers and investors, which is positively impacting the Islamic Finance Market. Educational initiatives, including workshops, seminars, and online courses, are being implemented to enhance knowledge about Sharia-compliant financial products. This increased awareness is particularly evident among younger generations who are more inclined to seek financial solutions that align with their ethical beliefs. As more individuals become educated about the benefits and workings of Islamic finance, the demand for these products is likely to rise. Furthermore, financial institutions are investing in marketing strategies to promote their Islamic finance offerings, thereby reaching a wider audience. This trend suggests that the Islamic Finance Market is on the cusp of a significant transformation, driven by informed consumers who are actively seeking ethical investment opportunities.

Regulatory Support and Frameworks

The Islamic Finance Market benefits from supportive regulatory frameworks that are being established in various jurisdictions. Governments and regulatory bodies are increasingly recognizing the importance of Islamic finance in promoting financial inclusion and economic development. For example, several countries have introduced specific regulations to facilitate the growth of Islamic banking and finance, which has led to a more structured and secure environment for investors. The establishment of Sharia advisory boards and the standardization of Islamic financial products are also contributing to the industry's credibility. As regulatory support continues to strengthen, it is anticipated that the Islamic Finance Market will attract more investors, both institutional and retail, thereby enhancing its overall growth potential. This supportive environment is crucial for fostering innovation and ensuring that Islamic finance remains competitive in the broader financial landscape.

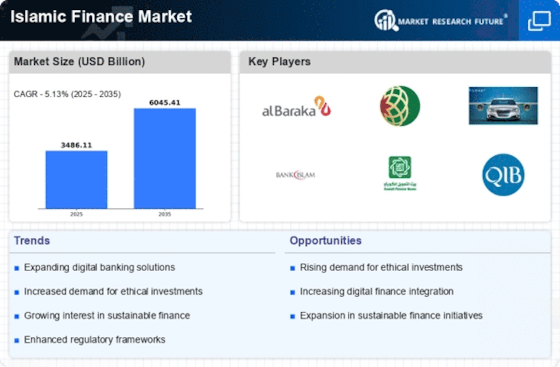

Growing Demand for Ethical Investments

The Islamic Finance Market is witnessing a notable increase in demand for ethical investment options. Investors are increasingly seeking financial products that align with their values, particularly in regions with significant Muslim populations. This trend is driven by a broader societal shift towards sustainability and ethical considerations in finance. According to recent estimates, the Islamic finance assets are projected to reach approximately 3 trillion USD by 2025, indicating a robust growth trajectory. This demand is not only limited to traditional Islamic finance products but also extends to green sukuk and socially responsible investment funds, which are gaining traction among investors. The growing awareness of ethical finance principles is likely to further propel the Islamic Finance Market, as more individuals and institutions recognize the importance of aligning their financial activities with their moral and ethical beliefs.

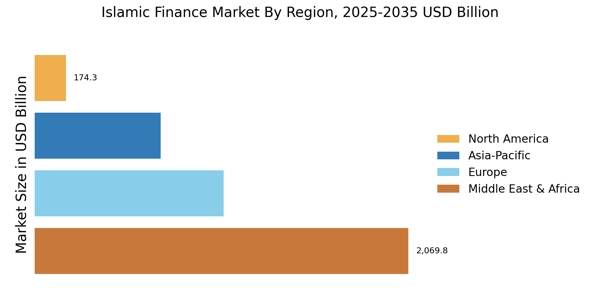

Expansion of Islamic Finance into New Markets

The Islamic Finance Market is experiencing expansion into new markets, which is indicative of its growing global appeal. Countries with emerging economies are increasingly recognizing the potential of Islamic finance to stimulate economic growth and attract foreign investment. For instance, regions in Africa and Southeast Asia are witnessing a surge in Islamic banking institutions and financial products, as governments seek to diversify their financial systems. This expansion is not only limited to traditional banking but also encompasses sectors such as insurance (Takaful) and capital markets. The diversification of Islamic finance offerings is likely to enhance its attractiveness to a broader range of investors. As more countries adopt Islamic finance principles, the industry is expected to flourish, creating new opportunities for growth and collaboration within the Islamic Finance Market.

Technological Advancements in Financial Services

Technological advancements are playing a pivotal role in shaping the Islamic Finance Market. The integration of fintech solutions, such as blockchain and artificial intelligence, is enhancing the efficiency and accessibility of Islamic financial products. These technologies facilitate faster transactions, improve transparency, and reduce operational costs, making Islamic finance more appealing to a broader audience. For instance, the adoption of blockchain technology in sukuk issuance is streamlining processes and ensuring compliance with Sharia principles. Furthermore, the rise of digital banking platforms tailored to Islamic finance is expanding the reach of these services, particularly among younger demographics. As technology continues to evolve, it is expected that the Islamic Finance Market will experience increased innovation, leading to the development of new products and services that cater to the diverse needs of consumers.