Rising Focus on Safety and Security

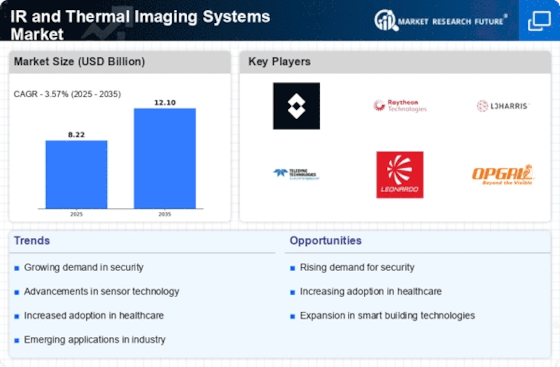

The IR and Thermal Imaging Systems Market is significantly influenced by the increasing emphasis on safety and security measures across various sectors. Law enforcement agencies, military, and private security firms are adopting thermal imaging technology for surveillance, threat detection, and search and rescue operations. The ability to detect heat signatures in low visibility conditions enhances situational awareness and response capabilities. Market data indicates that the security segment is expected to witness robust growth, as organizations prioritize investments in advanced surveillance technologies to mitigate risks and ensure public safety. This trend is likely to drive innovation and development within the thermal imaging sector.

Expanding Applications in Healthcare

The IR and Thermal Imaging Systems Market is increasingly finding applications in the healthcare sector, particularly in diagnostics and patient monitoring. Thermal imaging technology is being utilized for non-invasive assessments, such as detecting inflammation, monitoring blood flow, and identifying abnormal tissue growth. The growing awareness of the benefits of thermal imaging in medical diagnostics is driving its adoption among healthcare professionals. Market data indicates that the healthcare segment is projected to grow significantly, as hospitals and clinics invest in advanced imaging technologies to enhance patient care and improve diagnostic accuracy. This trend is likely to propel the overall growth of the thermal imaging market.

Growing Demand in Industrial Applications

The IR and Thermal Imaging Systems Market is experiencing a notable surge in demand across various industrial sectors. Industries such as manufacturing, oil and gas, and power generation are increasingly utilizing thermal imaging for predictive maintenance and equipment monitoring. This technology enables early detection of equipment failures, thereby reducing downtime and maintenance costs. According to recent data, the industrial segment is projected to account for a substantial share of the market, driven by the need for enhanced operational efficiency and safety. Furthermore, the integration of thermal imaging with automation systems is likely to bolster its adoption, as industries seek to optimize processes and improve productivity.

Advancements in Technology and Miniaturization

Technological advancements play a crucial role in shaping the IR and Thermal Imaging Systems Market. The miniaturization of thermal imaging devices has made them more accessible and versatile for various applications. Innovations in sensor technology, image processing, and data analytics are enhancing the performance and functionality of thermal imaging systems. As a result, these systems are being integrated into portable devices, drones, and smartphones, expanding their usability in fields such as agriculture, construction, and environmental monitoring. The market is expected to benefit from these advancements, as they enable users to leverage thermal imaging for a broader range of applications, thereby driving growth.

Increasing Investment in Research and Development

The IR and Thermal Imaging Systems Market is witnessing a surge in investment directed towards research and development initiatives. Companies are focusing on developing next-generation thermal imaging solutions that offer improved accuracy, resolution, and user-friendliness. This investment is crucial for fostering innovation and maintaining competitive advantage in a rapidly evolving market. Furthermore, collaboration between technology firms and research institutions is likely to accelerate the development of advanced thermal imaging technologies. Market analysis suggests that sustained R&D efforts will contribute to the introduction of novel applications and functionalities, thereby expanding the overall market landscape.