Iot Microcontroller Size

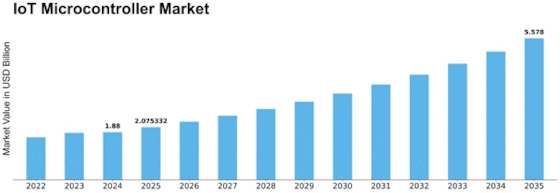

IoT Microcontroller Market Growth Projections and Opportunities

Numerous variables impact the IoT microcontroller industry, which in turn shapes its dynamics and future direction. The growing need for linked devices across a variety of businesses is one important cause. Microcontrollers that can provide smooth communication and data interchange between devices are becoming more and more necessary as a result of the growth of Internet of Things applications, which include smart homes, industrial automation, healthcare, and more. A major factor in the market's expansion is the spike in demand, which forces producers to create ever-more-advanced microcontrollers to satisfy the changing needs of the Internet of Things. In the market for IoT microcontrollers, cost is a major factor. The need for affordable microcontroller solutions is rising as the use of IoT technologies spreads. Because manufacturers are always under pressure to provide high-performance microcontrollers at competitive costs, cost effectiveness plays a big role in determining how the market is structured. This element is especially important for applications like smart city and industrial IoT deployments where a large-scale deployment of linked devices is necessary. Technological developments in the design and manufacture of microcontrollers are important drivers of the industry. The competitive environment is defined by the unrelenting quest of downsizing, increased computing power, and greater energy efficiency. Advancements in chip architecture, materials, and fabrication procedures facilitate the creation of microcontrollers that are increasingly potent and efficient. In order to maintain their position at the forefront of technical advancement and to keep their microcontrollers competitive in the ever changing IoT industry, manufacturers make Standards and protocols for connectivity play a crucial role in determining the IoT microcontroller industry. Interoperability is made possible via established protocols, which are necessary for devices to communicate with one other without any problems. The industry is seeing attempts to create common standards as the IoT ecosystem grows. Widely used communication protocols make it possible for devices made by many manufacturers to function together harmoniously, promoting a more unified and user-friendly Internet of things. The way in which connectivity standards are developed and implemented is a key factor in shaping market dynamics.

Leave a Comment