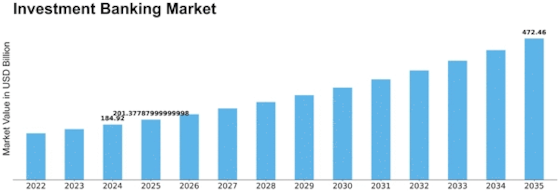

Investment Banking Size

Investment Banking Market Growth Projections and Opportunities

Recent developments in the investment banking sector are significant. Banks and financial institutions offer investment banking services to businesses, governments, and wealthy individuals. It comprises generating finance, approving safeguards, assisting with consolidations and acquisitions, and warning aid. Key variables drive Investment Banking market aspects.

Rising interest in capital raising and facilitating arrangements drives the Investment Banking sector. Associations often need more funds to grow, expand, or pursue critical goals in today's competitive business environment. Investment banks help firms raise cash through initial public offerings, obligation issuances, and confidential positions. Investment banks help organizations secure necessary subsidies by providing access to capital markets and using their expertise.

The trend toward M&A and corporate reconstruction also affects the Investment Banking business. M&As are important for companies looking to gain a competitive edge, expand their market, or simplify their operations. Investment banks help with M&A transactions by warning, guiding effort, and coordinating deals. They help organizations set strategic goals, negotiate agreements, and understand complex administrative and legal requirements. Market growth is driven by investment banking administrations' M&A and corporate rebuilding desire.

Globalization of monetary markets is also changing Investment Banking market aspects. As companies expand internationally, they need particular knowledge and skills to understand global markets. Investment funds with a global presence and strong relationships are well-positioned to provide cross-line warning services, cooperate with global exchanges, and help customers navigate new capital markets. Internationalization of financial markets has increased investment banking administration interest, propelling industry growth.

The growing emphasis on risk by executives and administrative consistency is also affecting Investment Banking market aspects. In response to the global financial crisis, regulators have imposed stronger financial foundation requirements to ensure strength and protect investors. Investment banks must comply with Basel III, Dodd-Straightforward, and MiFID II, which affect their operations and board practice. Investment banks that can manage risk, ensure consistency, and maintain strong administration systems will succeed.

Leave a Comment