Top Industry Leaders in the Intrinsically Safe Equipment Market

Competitive Landscape of the Intrinsically Safe Equipment Market:

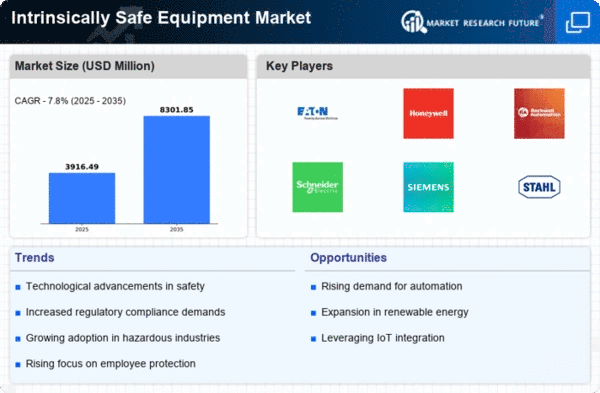

The intrinsically safe (IS) equipment market, catering to industries rife with flammable, explosive, or combustible hazards, has been steadily expanding, propelled by heightened safety regulations and a growing focus on operational efficiency. Attracting both established players and agile newcomers. Navigating this competitive landscape requires a deep understanding of the adopted strategies, market share determinants, and emerging trends.

Key Players:

- Pepperl + Fuchs

- Fluke Corporation

- OMEGA Engineering (Spectris PLC)

- Stahl AG

- RAE Systems (Honeywell)

- Eaton Corporation

- CorDEX Instruments Ltd.

- Bayco Products, Inc.

- Kyland Technology Co., Ltd.

- Banner Engineering Corp.

- Georgin

Strategies Adopted by Key Players:

Global giants like Pepperl+Fuchs, Fluke Corporation, R. STAHL, and RAE Systems (Honeywell) have long dominated the market, capitalizing on their extensive product portfolios, robust distribution networks, and brand recognition. These established players rely on a multi-pronged approach:

- Product Diversification: Offering a comprehensive range of IS equipment, catering to diverse industry needs and applications. From basic tools like lighting and communication systems to sophisticated gas detectors and control panels, established players cover all bases.

- Technological Innovation: Continuously investing in research and development, pushing the boundaries of IS technology. This includes advancements like miniaturization, improved energy efficiency, and integration with IoT platforms for remote monitoring and data analysis.

- Strategic Acquisitions: Acquiring promising startups or smaller players to expand their market reach and product offerings. This allows them to tap into new market segments or access cutting-edge technologies.

- Global Presence: Establishing a strong foothold in key geographic regions, particularly emerging markets with stringent safety regulations and a burgeoning industrial base. This involves setting up manufacturing facilities, forging local partnerships, and tailoring product offerings to regional needs.

Factors Shaping Market Share

While established players hold a significant market share, their dominance is constantly challenged by several factors:

- Industry Regulations: Stringent safety regulations, like ATEX and IECEx, continuously evolve, demanding equipment manufacturers to adapt and comply. Companies with a proven track record of meeting these regulations and offering compliant products gain an edge.

- Price Sensitivity: Cost remains a crucial factor for many buyers, particularly in price-competitive segments. New entrants or smaller players offering cost-effective alternatives can disrupt the market share of established players.

- Technological Advancements: Rapid technological advancements in areas like wireless communication, automation, and artificial intelligence create opportunities for new players to develop innovative IS solutions that cater to specific needs.

- Customer Service and Support: Providing excellent customer service and technical support is paramount in this safety-critical industry. Prompt response times, readily available spare parts, and training programs build trust and loyalty among customers.

New Entrants and Emerging Trends:

The IS equipment market is witnessing a surge of new entrants, particularly in niche segments with high growth potential. These startups are often characterized by:

- Focus on Specific Technologies: They specialize in developing cutting-edge solutions in areas like wireless sensor networks, intrinsically safe drones, or wearable technology for enhanced worker safety.

- Agility and Innovation: They are quick to adapt to changing market needs and regulations, bringing fresh perspectives and innovative solutions to the table.

- Data-Driven Approach: They leverage data analytics and AI to develop intelligent IS equipment that optimizes operations and improves safety outcomes.

- Sustainable Solutions: They are increasingly focusing on developing eco-friendly IS equipment with lower energy consumption and smaller footprints, aligning with the growing demand for sustainable practices.

Industry Developments

Fluke Corporation:

- Oct 25, 2023: Launched the Fluke 709Ex Intrinsically Safe Thermal Imager, featuring improved resolution, sensitivity, and ease of use compared to previous models.

- Jan 10, 2024: Announced a partnership with Extronics, Inc. to expand its distribution network for intrinsically safe test and measurement equipment in the Northeast US.

- Focus: Fluke emphasizes ruggedness, reliability, and user-friendliness in its Ex-rated tools, catering to electricians, technicians, and inspectors in hazardous environments.

OMEGA Engineering (Spectris PLC):

- Dec 5, 2023: Acquired Tempcon Instrumentation Ltd., a UK-based manufacturer of intrinsically safe temperature sensors and transmitters, strengthening its presence in the European market.

- Nov 15, 2023: OMEGA's PS Series Pressure Switches received ATEX and IECEx certifications for intrinsically safe use in hazardous areas.

- Focus: OMEGA offers a wider range of intrinsically safe products, including temperature sensors, pressure gauges, data loggers, and process controllers, targeting diverse industries like chemical processing, food & beverage, and pharmaceuticals.