Regulatory Support for IVIG Therapies

Regulatory support for intravenous immunoglobulin therapies is emerging as a crucial driver for the Intravenous Immunoglobulin Market. Regulatory agencies are increasingly recognizing the therapeutic benefits of IVIG, leading to streamlined approval processes for new products. This supportive regulatory environment encourages innovation and investment in the development of novel IVIG formulations. Additionally, the establishment of guidelines for the safe and effective use of IVIG therapies is fostering confidence among healthcare providers. As a result, the market is likely to witness an influx of new entrants and product offerings, further stimulating growth. The ongoing collaboration between regulatory bodies and industry stakeholders is expected to enhance the overall landscape of the IVIG market.

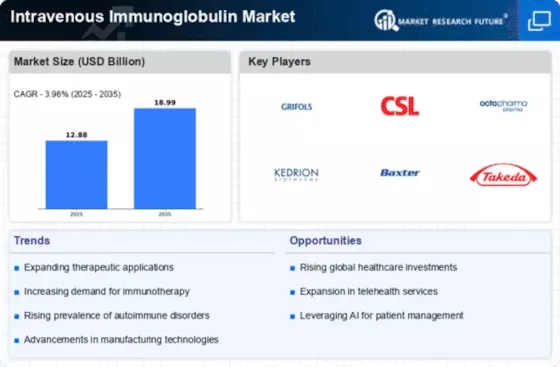

Advancements in Manufacturing Technologies

Technological advancements in the production of intravenous immunoglobulin are driving the Intravenous Immunoglobulin Market forward. Innovations in purification and fractionation processes have enhanced the efficiency and yield of IVIG products. For instance, the introduction of new chromatographic techniques has improved the quality and safety of immunoglobulin preparations. As a result, manufacturers can produce higher volumes of IVIG while maintaining stringent quality standards. This increase in production capacity is crucial, given the rising demand for IVIG therapies across various therapeutic areas. Furthermore, these advancements may lead to cost reductions, making IVIG more accessible to healthcare providers and patients alike. The ongoing evolution of manufacturing technologies is likely to play a pivotal role in shaping the future landscape of the IVIG market.

Rising Incidence of Neurological Disorders

The growing prevalence of neurological disorders is significantly influencing the Intravenous Immunoglobulin Market. Conditions such as Guillain-Barre syndrome, chronic inflammatory demyelinating polyneuropathy, and myasthenia gravis are increasingly diagnosed, necessitating effective treatment options. Data indicates that neurological disorders affect millions worldwide, with conditions like multiple sclerosis alone impacting over 2.3 million individuals. IVIG therapy has been recognized for its efficacy in treating these disorders, leading to a surge in demand. As healthcare systems evolve to address these challenges, the reliance on IVIG as a therapeutic option is expected to increase. This trend highlights the potential for market expansion, as more patients seek innovative treatments for their neurological conditions.

Growing Awareness of Immunotherapy Benefits

The increasing awareness of the benefits of immunotherapy is a significant driver for the Intravenous Immunoglobulin Market. As healthcare professionals and patients become more informed about the role of immunoglobulins in treating various diseases, the demand for IVIG therapies is expected to rise. Educational initiatives and clinical studies highlighting the efficacy of IVIG in managing immune deficiencies and autoimmune disorders are contributing to this trend. Market data suggests that the immunotherapy segment is projected to grow at a compound annual growth rate (CAGR) of over 8% in the coming years. This growing recognition of immunotherapy's potential is likely to enhance the adoption of IVIG treatments, thereby expanding the market.

Increasing Prevalence of Autoimmune Disorders

The rising incidence of autoimmune disorders is a notable driver for the Intravenous Immunoglobulin Market. Conditions such as rheumatoid arthritis, lupus, and multiple sclerosis are becoming more prevalent, leading to a heightened demand for effective treatment options. According to recent estimates, autoimmune diseases affect approximately 5-8% of the population, which translates to millions of individuals requiring therapeutic interventions. Intravenous immunoglobulin (IVIG) therapy has emerged as a critical treatment modality for these conditions, providing essential immunological support. As awareness of autoimmune disorders increases, healthcare providers are likely to prescribe IVIG more frequently, thereby propelling market growth. This trend suggests a sustained demand for IVIG products, as patients seek effective management strategies for their chronic conditions.