Growing Geriatric Population

The growing geriatric population is a significant driver of the Intermittent Pneumatic Compression IPC Device Market. As the global population ages, the incidence of age-related health issues, such as venous disorders, is on the rise. Older adults are particularly susceptible to conditions that IPC devices can effectively manage, such as DVT and chronic venous insufficiency. This demographic shift is expected to result in a heightened demand for IPC therapy, with projections indicating that the market could expand by approximately 9% annually as healthcare systems adapt to meet the needs of this aging population.

Expansion in Emerging Markets

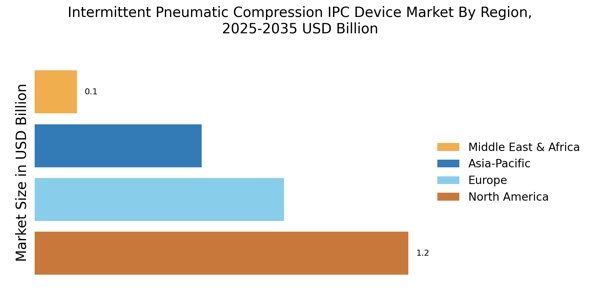

The Intermittent Pneumatic Compression IPC Device Market is witnessing significant expansion in emerging markets. Countries in Asia and Latin America are increasingly investing in healthcare infrastructure, leading to greater accessibility of IPC devices. The rising prevalence of chronic diseases and an aging population in these regions are further propelling the demand for effective treatment options. Market analysts suggest that the IPC device market in these areas could see a growth rate of over 10% annually, as healthcare providers seek to incorporate advanced therapeutic solutions into their practices.

Rising Awareness of Preventive Care

There is a notable increase in the awareness of preventive care among healthcare professionals and patients alike, which is positively influencing the Intermittent Pneumatic Compression IPC Device Market. As more individuals recognize the importance of preventing conditions such as deep vein thrombosis (DVT) and lymphedema, the demand for IPC devices is likely to rise. Educational campaigns and initiatives by healthcare organizations are contributing to this trend, emphasizing the role of IPC therapy in enhancing recovery and preventing complications. This growing awareness is expected to drive market growth, with an estimated increase in device adoption rates by 15% in the coming years.

Technological Advancements in IPC Devices

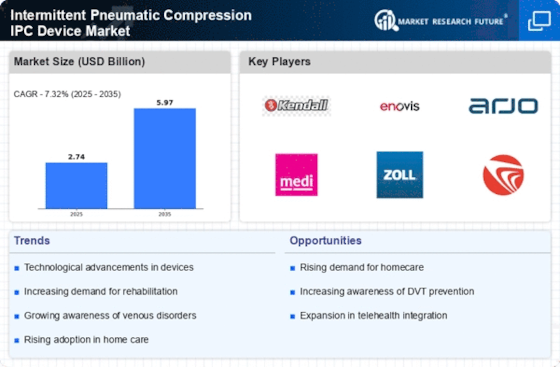

The Intermittent Pneumatic Compression IPC Device Market is experiencing a surge in technological advancements. Innovations such as smart IPC devices equipped with sensors and connectivity features are enhancing patient monitoring and treatment efficacy. These devices can now provide real-time feedback, allowing healthcare providers to adjust treatment protocols based on individual patient needs. The integration of artificial intelligence and machine learning into IPC devices is also on the rise, potentially improving outcomes by personalizing therapy. As a result, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 7% over the next five years, driven by these technological enhancements.

Regulatory Support and Reimbursement Policies

Regulatory support and favorable reimbursement policies are playing a crucial role in shaping the Intermittent Pneumatic Compression IPC Device Market. Governments and health authorities are increasingly recognizing the therapeutic benefits of IPC devices, leading to streamlined approval processes and enhanced reimbursement frameworks. This support not only encourages manufacturers to innovate but also facilitates patient access to these devices. As reimbursement policies become more favorable, it is anticipated that the adoption of IPC devices will increase, potentially leading to a market growth rate of around 8% over the next few years.