Top Industry Leaders in the Intelligent Document Processing Market

Competitive Landscape of the Intelligent Document Processing (IDP) Market: A Dive into Players, Strategies, and Investments

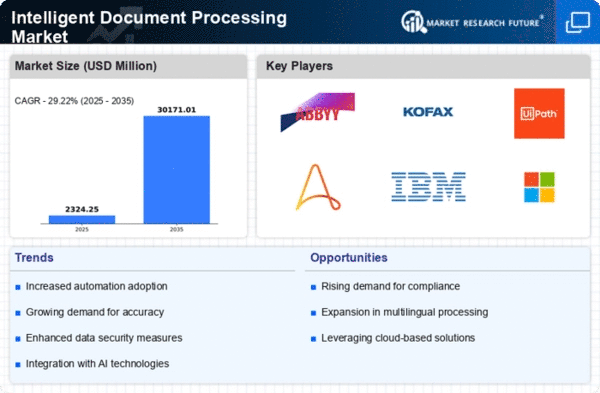

The Intelligent Document Processing (IDP) market is experiencing explosive growth, driven by the urgent need for enterprises to automate document-centric workflows and extract actionable insights. This dynamic space is teeming with established players, innovative startups, and diverse strategies, making it crucial to understand the competitive landscape to navigate successfully.

Key Players:

- IBM (United States)

- Kofax (United States)

- WorkFusion (United States)

- ABBYY (United States)

- Automation Anywhere (United States)

- Appian (United States)

- UiPath (United States)

- Datamatics (India)

- Deloitte (United Kingdom)

- AntWorks (Singapore)

- OpenText (Canada)

- Celaton (United Kingdom)

- HCL Technologies (India)

- Kodak Alaris (United Kingdom)

Strategies Adopted:

- Product Differentiation: Leading players like ABBYY and Hyperscience focus on advanced capabilities like context-aware understanding, intelligent data extraction, and integration with cognitive services.

- Cloud-First Approach: Cloud-based IDP platforms offer scalability, flexibility, and faster deployment, driving adoption by SMBs and large enterprises alike.

- Partnerships and Acquisitions: Strategic collaborations are key to expanding reach and expertise. For example, Adobe partnered with IPaaS providers to offer comprehensive document automation solutions.

- Industry-Specific Solutions: Tailored offerings for verticals like healthcare, finance, and insurance address specific pain points and compliance requirements.

Factors for Market Share Analysis:

- Product Features: Functionality, accuracy, ease of use, and integration capabilities are critical differentiators.

- Deployment Options: Cloud, on-premise, or hybrid models cater to diverse needs and budgets.

- Customer Base: Industry focus, geographic reach, and enterprise size influence market share.

- Pricing Models: Subscription-based, pay-per-use, or volume-based pricing impact vendor selection.

- Brand Reputation: Established players have an advantage, while innovative startups can disrupt with unique value propositions.

Emerging Companies and Trends:

- AI-powered Startups: Companies like Nanonets and PyTorch are bringing advanced AI capabilities like natural language processing (NLP) and computer vision (CV) to IDP, enabling deeper document insights.

- Low-code/No-code Platforms: Platforms like Unqork and IPaaS solutions are simplifying IDP implementation, making it accessible to even non-technical users.

- RPA Integration: The convergence of IDP and Robotic Process Automation (RPA) is creating end-to-end automation solutions for complex document workflows.

Current Company Investment Trends:

- Focus on R&D: Leading players are investing heavily in AI and ML research to enhance accuracy, automation, and decision-making capabilities.

- Open-source Adoption: Embracing open-source technologies like TensorFlow and PyTorch fosters innovation and lowers barriers to entry for new players.

- Global Expansion: Established companies are venturing into new geographies to capture market share in emerging economies.

- Strategic Partnerships: Collaborations with industry leaders and technology giants are accelerating product development and market penetration.

Latest Company Updates:

In the IDC MarketScape: Worldwide Intelligent Document Processing Software 2023-2024 Vendor Assessment, Rossum, a leading Intelligent Document Processing (IDP) platform, is pleased to announce its recognition as a Leader in 2023. Human-centric automation, orchestration and integration, and productivity for large enterprises were identified as strengths of Rossum.