Aging Population

The aging population is a critical factor influencing the Global Integrated Cardiology Devices Market Industry. As life expectancy increases, the incidence of age-related cardiovascular conditions rises correspondingly. Older adults are more susceptible to heart diseases, necessitating the use of integrated cardiology devices for effective management. In many developed nations, the proportion of individuals aged 65 and older is projected to increase significantly over the next decade. This demographic shift is expected to drive market growth, as healthcare providers seek to address the unique needs of this population through advanced cardiology solutions.

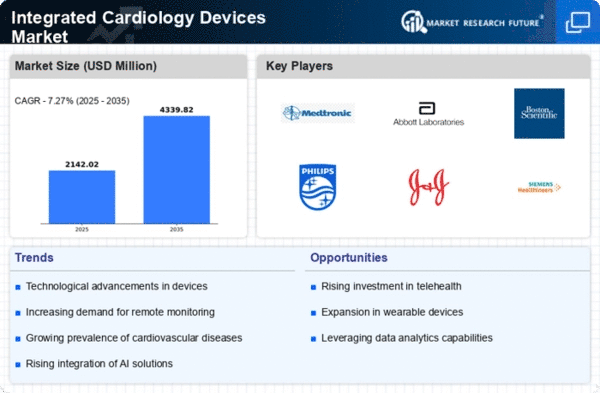

Market Growth Projections

The Global Integrated Cardiology Devices Market Industry is projected to witness substantial growth over the coming years. With a compound annual growth rate of 7.75% anticipated from 2025 to 2035, the market is expected to expand significantly. By 2035, the market is forecasted to reach 11.2 USD Billion, reflecting the increasing demand for integrated solutions in cardiology. This growth trajectory is supported by various factors, including technological advancements, rising cardiovascular diseases, and an aging population. The combination of these elements suggests a robust future for the industry.

Technological Advancements

The Global Integrated Cardiology Devices Market Industry is experiencing rapid technological advancements, which enhance the efficacy and efficiency of cardiology devices. Innovations such as remote monitoring systems and advanced imaging technologies are becoming increasingly prevalent. These advancements not only improve patient outcomes but also streamline clinical workflows. For instance, the integration of artificial intelligence in diagnostic tools allows for more accurate assessments, potentially reducing the time to diagnosis. As a result, the market is projected to grow from 4.92 USD Billion in 2024 to 11.2 USD Billion by 2035, indicating a robust demand for these advanced solutions.

Rising Cardiovascular Diseases

The prevalence of cardiovascular diseases is a significant driver for the Global Integrated Cardiology Devices Market Industry. With an increasing number of individuals diagnosed with conditions such as hypertension and coronary artery disease, there is a heightened demand for effective cardiology devices. According to recent statistics, cardiovascular diseases account for a substantial portion of global mortality rates, prompting healthcare systems to invest in integrated solutions. This trend is likely to continue, as the World Health Organization projects that by 2030, cardiovascular diseases will remain the leading cause of death globally. Consequently, this growing patient population drives the need for innovative cardiology devices.

Growing Awareness and Education

Growing awareness and education regarding cardiovascular health are vital drivers for the Global Integrated Cardiology Devices Market Industry. Public health campaigns and educational initiatives are increasingly informing individuals about the risks associated with cardiovascular diseases and the importance of early detection. This heightened awareness is leading to more individuals seeking medical advice and interventions, thereby increasing the demand for integrated cardiology devices. Healthcare providers are also emphasizing preventive measures, which further contributes to the market's expansion. As awareness continues to rise, the market is expected to experience sustained growth.

Increased Healthcare Expenditure

Increased healthcare expenditure is propelling the Global Integrated Cardiology Devices Market Industry forward. Governments and private sectors are allocating more resources to healthcare, particularly in cardiology, to improve patient care and outcomes. This trend is evident in various countries, where healthcare budgets are expanding to accommodate advanced medical technologies. For instance, countries with robust healthcare systems are investing in integrated cardiology devices to enhance diagnostic and treatment capabilities. As a result, this increase in funding is likely to facilitate the adoption of innovative cardiology solutions, further driving market growth.