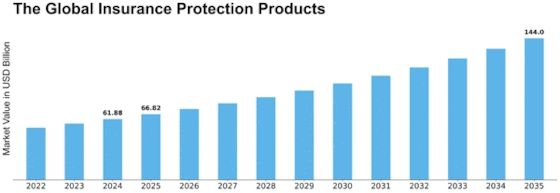

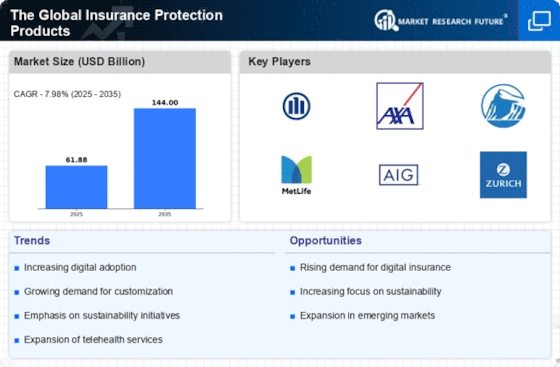

Insurance Protection Product Size

Insurance Protection Product Market Growth Projections and Opportunities

The Insurance Protection Product Market is strongly influenced by the evolving regulatory environment. Changes in insurance regulations, compliance requirements, and consumer protection policies impact the design and distribution of insurance protection products, shaping market dynamics. Due to the increasing realization of individuals and businesses that they require financial stability, this creates demand for insurance products. The market for different insurance products is driven by the fact that consumer wish to be protected financially if unfortunate circumstances happen. Continuous technological development, especially in the field of insurtech greatly influences the market. Digitalization, data analytics and artificial intelligence integration simplify insurance operations; improve customer satisfaction levels as well as open new opportunities for innovative protection products. Insurance protection products market is also under the influence of demographic changes and shifting perceptions on risk. With demographic shifts, people and organizations reconsider their risk exposure as well as need customized coverage opportunities. This in turn paves way for innovations towards product specializations to fulfill various needs. The global economic situation majorly determines the structure of an insurance protection product market. Economic ups and downs, market uncertainties as well as geopolitical events affect the demand for specific coverage types showing the close link between economic stability and insurance requirements. The market features the emergence of specialised insurance products which focus on specific risks or industries. Customized production of protection products for specific demands, like cyber insurance or cancelation event coverage leads to the industry’s responsiveness towards newly arising risks and market needs. Among the greatest areas affected by health and wellness trends are life insurance protection products especially in the field of both, Health Insurance & Life insurance. The market reflects the preferences of consumers who prefer policies that match with healthy lifestyles by providing incentives and coverage alternatives aimed to promote well-being. Growth in consciousness regarding environmental and climate risks propels the market for insurance protection products. They provide insurance cover on natural disasters and climate-related events as well, environmental liabilities. This helps people to be sure that even when their properties are destroyed they will still get some of the money lost because natural disaster does not spare anything including humans Contemporary global pandemics, including COVID-19 increased the sensitivity of the business world towards insurance protection to ensure proper continuity. The insurers respond by coming up with the products to address pandemic risks as well as help businesses manage financial losses. Partnerships and collaborations in insurance are critical driving force to market growth. Insurers, reinsurers brokers and insurtech companies work together to generate synergies; sources of expertise as well as develop integrated protection products that provide solutions for complicated risks.

Regulatory support for innovation and insurtech initiatives impacts the market's ability to introduce new and innovative protection products. Regulatory bodies that foster a conducive environment for experimentation and digital transformation contribute to market vibrancy and innovation.

Leave a Comment