Market Share

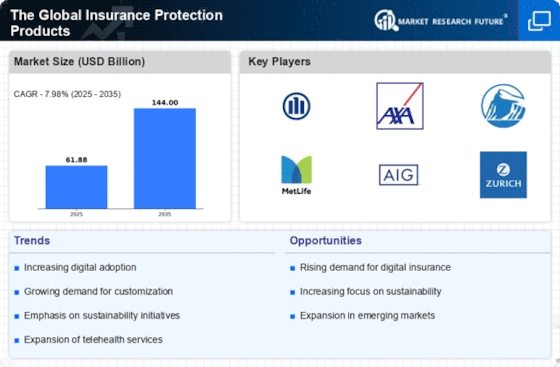

Insurance Protection Product Market Share Analysis

Establishing a strong market share position in the Insurance Protection Product Market begins with offering a diverse portfolio. Companies can provide a range of insurance products, including life insurance, health insurance, disability insurance, and critical illness coverage, catering to the varied needs and preferences of consumers. Product design innovation is essential for market competitiveness. However, they should pay more attention to the creation of products with innovative characteristics – customized coverage options, fast underwriting operations and peculiar riders. Digital transformation is strategic. Companies can invest in user-friendly online platforms, mobile apps and digital interfaces that will promote accessibility for clients. Call smoothing the purchasing process, claims submission routine and customer interactions lead to market desirability. The most important thing is to develop insurance products that have affordable premiums and flexible payment schemes. Companies require innovative approaches in payment plans, bundled coverage discounts and more cost-effective underwriting processes to facilitate a wider customer base. Segmentation based targeted marketing initiatives lead to market success. Companies can customize their marketing plans towards various segments of the population, highlighting features and benefits relevant to specific demographics. Strong partnerships with the partners in distribution is a strategy. Companies can work together with insurance brokers, financial advisors as well as affinity groups to extend the reach while also targeting networks already in place hence increasing market visibility and customer acquisition. Being reactive to regulatory changes is critical. The market forces for insurance companies to keep updating in regulations of incensement must monitor, adapt and act proactively changes of compliances creating competitive advantages. Market growth is greatly dependent on the development of customer educational programs. Companies can conduct seminars, webinars and educational campaigns to educate the consumers on why insurance protection is necessary; what type of coverage they need among other things plus specific benefits that their products have over others in the market. The risk management and underwriting skills shown should be strong enough. The business organizations must allocate funds for the proficiency underwriters, advanced risk quantification tools and data analytics to allow more precision in the process of underwriting prices with appropriate pricing as well as managing risks prudently. Trust is inbuilt. Companies should spend their time and money on image creation through branding, advertising and public relations to ensure that in the minds of consumers there is a positive reliable mental picture which will create trust for insurance protection products.

Continuous product adaptation and innovation are imperative. Companies should actively monitor market trends, consumer feedback, and emerging risks to adapt their insurance protection products, ensuring relevance and competitiveness in the ever-changing insurance landscape.

Leave a Comment