- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

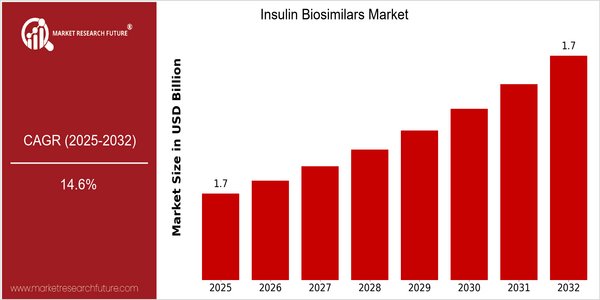

Insulin Biosimilars Market Size Snapshot

| Year | Value |

|---|---|

| 2025 | USD 1.68 Billion |

| 2032 | USD 1.68 Billion |

| CAGR (2023-2032) | 14.6 % |

Note – Market size depicts the revenue generated over the financial year

The Insulin Biosimilars Market is expected to grow at a CAGR of 14.26% from 2025 to 2032. This growth, combined with a CAGR of 14.6% from 2023 to 2032, indicates a dynamic market driven by the growing demand for diabetes management solutions. The rising prevalence of diabetes in the world, combined with the expiration of several patents on insulin products, is a fertile environment for biosimilars to enter the market. Further growth is expected to be driven by technological developments in biomanufacturing processes and regulatory frameworks that facilitate the approval of biosimilars. The market is dominated by Sanofi, Novo Nordisk and Amgen, which are investing heavily in research and development, entering into strategic alliances and launching new products to capture market share. Recent alliances to increase production and expand distribution networks are an example of the strategies used to take advantage of the growing demand for insulin biosimilars. These factors will play a key role in the evolution of the market and the future landscape of diabetes care.

Regional Deep Dive

The Insulin Biosimilars Market is growing significantly in various regions, driven by the increasing prevalence of diabetes, rising health care costs, and the need for cost-effective treatment options. North America is characterized by advanced health care and innovation, while Europe is characterized by stringent regulatory frameworks that support the approval of biosimilars. The Asia-Pacific region is experiencing rapid growth, driven by the large diabetic population and the increasing government initiatives to promote biosimilars. The Middle East and Africa face the challenge of access to health care and are gradually improving through regional collaborations. Latin America is also emerging as a key region, driven by increasing investments in health care and the increasing demand for cost-effective treatments.

North America

- The US Food and Drug Administration has recently accelerated the approval of biosimilars, which is expected to speed up the market entry of new products and thus increase competition among manufacturers.

- In the field of insulin biosimilars, Amgen and Mylan are investing heavily, and the biosimilar of Lantus is already available.

- In the United States, where diabetes is increasingly common, the health system is looking for cheaper treatment options, which is driving the demand for biosimilars.

Europe

- The European Medicines Agency (EMA) has established a clear regulatory pathway for biosimilars. This has led to a significant increase in the number of biosimilars licensed for the manufacture of insulin over recent years.

- Companies like Sandoz and Biocon have already launched successful biosimilars in Europe, resulting in a more competitive market and lower prices for consumers.

- The biosimilars market is experiencing a high degree of acceptance in Europe. Both medical practitioners and patients are increasingly aware of their efficacy and safety, which is expected to further boost the market growth.

Asia-Pacific

- China and India have been the main consumers of biosimilars. These countries have large diabetic populations and government initiatives to improve access to medicines.

- The Indian government has been encouraging the development of biosimilars, with the help of the Biotechnology Industry Research Assistance Council (BIRAC).

- The arrival of local companies like Biocon in the biosimilars market is likely to increase competition and reduce prices.

MEA

- The African Union has launched a program of action to increase access to diabetes care, which also includes promoting the use of biosimilars as a cost-effective treatment option.

- Local governments and international organisations are working together to develop health care systems, which are important for the distribution of biosimilars.

- Several factors, such as cultural differences, influence the acceptance of biosimilars. The emergence of education and trust in these products, in some countries, are very slow.

Latin America

- In Brazil and Mexico, investments in the health care system are increasing, which will facilitate the introduction of biosimilars.

- Latin American authorities are beginning to adopt more favourable regulations for biosimilars, with ANVISA leading the way with its clear approval guidelines.

- The rising diabetes rate in the region has increased the demand for affordable insulin. Biosimilars offer a solution that is both cost-effective and attractive to patients and health care systems.

Did You Know?

“In the year 2045, the number of diabetics in the world is estimated to be seven hundred million. The need for an inexpensive insulin therapy is therefore urgent.” — International Diabetes Federation (IDF) Diabetes Atlas, 9th edition

Segmental Market Size

The biosimilars market is a rapidly growing market in the broader biopharmaceuticals industry, driven by the increasing prevalence of diabetes and the need for cost-effective treatment options. This market is currently experiencing strong growth as both healthcare systems and patients seek alternatives to expensive branded products. The increasing diabetes population requires more and more affordable treatment options. The supportive regulatory frameworks, such as the k(351) pathway in the United States, are also encouraging the development of biosimilars.

The development of insulin biosimilars is currently at the stage of a scaled deployment, with the likes of Sandoz and Mylan leading the charge in various regions, such as Europe and North America. They are being used in the treatment of diabetes in both Type I and Type II patients. Semglee and Abasaglar are the most popular products in this regard. There are several trends that are driving the growth of this market, including the need to contain the cost of health care and the increasing emphasis on individualized medicine. Furthermore, advances in biomanufacturing and analytical methods are ensuring that the quality and efficacy of biosimilars meet regulatory standards.

Future Outlook

The market for biosimilars is projected to expand at a CAGR of 14.6% from 2025 to 2032. This growth is largely due to the increasing prevalence of diabetes, which according to the International Diabetes Federation is expected to rise to 700 million cases by 2045. Biosimilars are expected to gain a larger share of the market, and the penetration of the biosimilars is projected to rise from approximately 20% in 2025 to over 40% in 2032. The biosimilars are expected to be aided by the favourable regulatory frameworks and the increasing acceptance of the biosimilars by the health care professionals and the patients.

The development of certain technological advances, such as improved production methods and improved delivery systems, will also boost the market. Next-generation biosimilars with improved efficacy and safety profiles are likely to attract more patients to switch from traditional therapies. The other important factor is government initiatives aimed at reducing the cost of diabetes care and increasing access to diabetes care. As the biosimilars market matures, emerging trends, such as the integration of digital health and personalized medicine, will also influence the competitive landscape, which will lead to a more robust and diverse product portfolio in the insulin biosimilars segment.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 14.6% (2023-2032) |

Insulin Biosimilars Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.