Rising Energy Costs

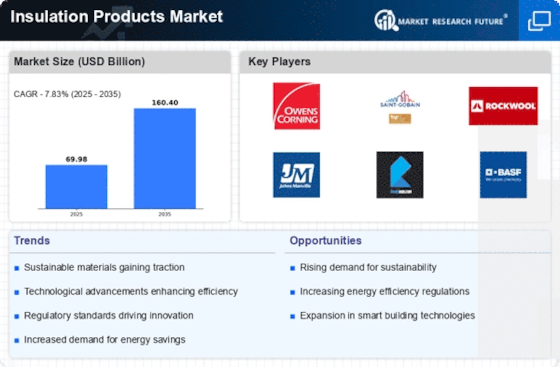

The Insulation Products Market is experiencing a notable surge in demand due to escalating energy costs. As energy prices continue to rise, consumers and businesses alike are increasingly seeking ways to reduce their energy consumption. Insulation products play a crucial role in enhancing energy efficiency within buildings, thereby lowering heating and cooling expenses. According to recent data, the energy efficiency sector is projected to grow significantly, with insulation products being a key component. This trend is likely to drive innovation and investment in the insulation market, as stakeholders aim to develop more effective and sustainable solutions to meet the growing demand for energy-efficient buildings.

Technological Innovations

The Insulation Products Market is witnessing a wave of technological innovations that are enhancing product performance and efficiency. Advances in materials science have led to the development of high-performance insulation products that offer superior thermal resistance and durability. Innovations such as reflective insulation and aerogel technology are gaining popularity, providing builders with more effective solutions for energy efficiency. Market analysis indicates that the integration of smart technologies in insulation products is also emerging, allowing for better monitoring and management of energy use. These technological advancements are expected to drive growth in the insulation market, as they offer significant benefits to both consumers and manufacturers.

Growing Environmental Concerns

The Insulation Products Market is increasingly influenced by growing environmental concerns among consumers and businesses. There is a rising awareness of the impact of energy consumption on climate change, prompting a shift towards sustainable building practices. Insulation products, particularly those made from eco-friendly materials, are gaining traction as they contribute to reducing carbon footprints. Market data suggests that the demand for sustainable insulation solutions is on the rise, as stakeholders seek to comply with environmental regulations and meet consumer preferences for greener options. This trend is likely to foster innovation in the insulation sector, leading to the development of new products that align with sustainability goals.

Increased Construction Activities

The Insulation Products Market is benefiting from a robust increase in construction activities across various sectors. With urbanization and population growth, there is a heightened demand for residential and commercial buildings. This surge in construction is accompanied by a growing awareness of the importance of energy-efficient designs, which often necessitate the use of high-quality insulation products. Recent statistics indicate that the construction sector is expected to expand, further propelling the insulation market. As builders and developers prioritize energy efficiency and sustainability, the insulation products market is poised for substantial growth, driven by the need for effective thermal and acoustic insulation solutions.

Regulatory Support for Energy Efficiency

The Insulation Products Market is significantly influenced by regulatory support aimed at promoting energy efficiency in buildings. Governments worldwide are implementing stringent building codes and standards that mandate the use of insulation products to enhance energy performance. This regulatory framework is encouraging builders and property owners to invest in high-quality insulation solutions. Recent data indicates that compliance with these regulations is becoming a critical factor in construction projects, thereby driving demand for insulation products. As regulations continue to evolve, the insulation market is likely to experience sustained growth, as stakeholders seek to meet compliance requirements while improving energy efficiency.