Market Share

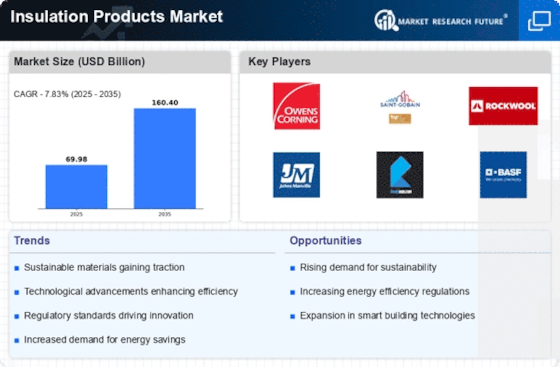

Insulation Products Market Share Analysis

Companies are attempting to foster their market share by diversifying their product portfolios. Offering a comprehensive range of insulation products, including materials for thermal, acoustic, and fire-resistant applications, allows companies to cater to diverse customer needs. A varied product portfolio positions a company as a one-stop solution provider, attracting a broader customer base. Staying at the forefront of innovation is a crucial strategy for market share positioning. Companies spend a lot on research and development to launch novel insulation materials and technologies. Innovations such as aerogel insulation, reflective insulation, and smart insulation systems enhance performance, providing a competitive advantage and attracting customers looking for cutting-edge solutions. One important development in the insulation market is the mounting demand for eco-friendly and sustainable solutions. Businesses are putting themselves out there by providing low-impact, biodegradable, and recycled insulating solutions. A dedication to sustainability increases market share by appealing to environmentally conscious consumers and matching with current market trends. Creating partnerships and strategic alliances is a typical approach to market expansion. To expand their market reach, businesses work with contractors, distributors, and other industry participants. By facilitating the sale of insulating products, these alliances help businesses expand into new markets, gain access to more resources, and improve their overall competitiveness. Positioning one's brand for market share necessitates a strong internet presence. Businesses engage in brand building through successful marketing strategies such as digital marketing, advertising, and trade show attendance. A well-known brand creates trust and brand loyalty, which leads people to choose its insulation products over competitors'. A important strategy for gaining market share is to achieve cost leadership through operational efficiency. Businesses use cost-effective production methods, manage their supply chains effectively, and optimize their manufacturing processes. Businesses can attract price-conscious customers and grow their market share by providing insulating materials at low costs. Staying updated and adjusting to changes in regulatory norms are essential for market share positioning. It is critical to follow building codes, energy efficiency regulations, and safety standards. Companies that respond to regulatory changes proactively position themselves as dependable and compliant, instilling trust in clients and contributing to market share gain. Educating customers on the benefits of various insulation solutions and their uses is a strategic step. Companies invest in educational activities to improve awareness about energy efficiency, environmental effect, and the long-term benefits of adequate insulation. Customers that are better educated are more likely to make informed judgments, and organizations that play a role in customer education can impact purchasing decisions and market share.

Leave a Comment