Increasing Regulatory Standards

The Industrial Seals Market is also being shaped by the increasing regulatory standards aimed at improving safety and environmental protection. Governments and regulatory bodies are implementing stringent guidelines that require industries to adopt high-quality sealing solutions to prevent leaks and emissions. This trend is particularly relevant in sectors such as chemicals and pharmaceuticals, where compliance with safety regulations is critical. As companies strive to meet these standards, the demand for reliable and effective seals is likely to rise. This regulatory pressure is expected to drive innovation and investment in the Industrial Seals Market, as manufacturers seek to develop products that not only comply with regulations but also enhance operational efficiency.

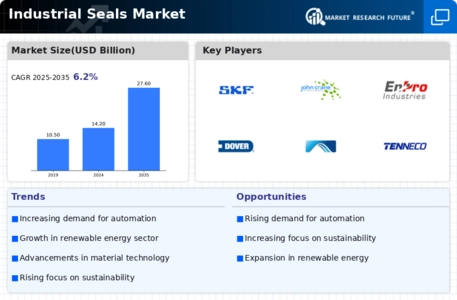

Growth in Renewable Energy Sector

The Industrial Seals Market is witnessing growth driven by the expansion of the renewable energy sector. As the world shifts towards sustainable energy sources, the demand for sealing solutions in wind, solar, and hydroelectric power generation is increasing. Seals play a crucial role in ensuring the efficiency and reliability of equipment used in these applications. For instance, wind turbines require high-performance seals to withstand harsh environmental conditions and maintain operational efficiency. The renewable energy sector has been growing at a rapid pace, with investments projected to reach trillions in the coming years. This growth is likely to create substantial opportunities for the Industrial Seals Market, as manufacturers develop specialized sealing solutions tailored to the unique requirements of renewable energy applications.

Rising Demand for Energy Efficiency

The Industrial Seals Market is experiencing a notable increase in demand for energy-efficient solutions. Industries are increasingly focusing on reducing energy consumption and operational costs, which drives the need for high-performance seals that minimize leakage and enhance system efficiency. According to recent data, energy-efficient seals can reduce energy losses by up to 30%, making them a critical component in various applications. This trend is particularly evident in sectors such as oil and gas, where the need for reliable sealing solutions is paramount. As companies strive to meet sustainability goals, the adoption of advanced sealing technologies is likely to accelerate, further propelling the Industrial Seals Market.

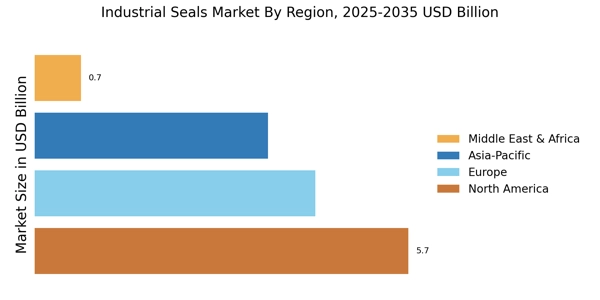

Expansion of Manufacturing Activities

The Industrial Seals Market is poised for growth due to the expansion of manufacturing activities across various sectors. As industries ramp up production to meet increasing consumer demand, the need for reliable sealing solutions becomes more pronounced. The manufacturing sector, which has shown a compound annual growth rate of approximately 4% in recent years, relies heavily on seals to ensure operational efficiency and equipment longevity. This growth is particularly evident in automotive and aerospace industries, where precision and reliability are critical. Consequently, the demand for high-quality industrial seals is expected to rise, driving the overall growth of the Industrial Seals Market.

Technological Innovations in Sealing Solutions

Technological advancements are significantly influencing the Industrial Seals Market. Innovations in materials and design are leading to the development of seals that offer enhanced performance, durability, and resistance to extreme conditions. For instance, the introduction of advanced elastomers and composite materials has improved the lifespan and reliability of seals in harsh environments. Furthermore, the integration of smart technologies, such as sensors within seals, is emerging as a trend that could revolutionize maintenance practices. These innovations not only enhance the functionality of sealing solutions but also contribute to the overall efficiency of industrial processes, thereby fostering growth in the Industrial Seals Market.