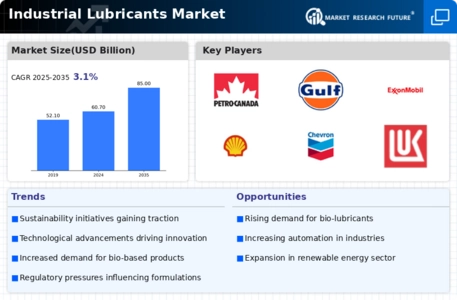

Top Industry Leaders in the Industrial Lubricants Market

The industrial lubricants market, though often overshadowed by its flashier automotive cousin, plays a crucial role in the smooth operation of the world's machinery. From towering wind turbines to the humble gears of factory production lines, these specialized lubricants reduce friction, wear, and heat, ensuring optimal performance and extended equipment life.

The industrial lubricants market, though often overshadowed by its flashier automotive cousin, plays a crucial role in the smooth operation of the world's machinery. From towering wind turbines to the humble gears of factory production lines, these specialized lubricants reduce friction, wear, and heat, ensuring optimal performance and extended equipment life.

Strategies Fueling Growth:

-

Innovation Prowess: Top players like ExxonMobil, Shell, and Chevron are investing heavily in R&D, pushing the boundaries of lubrication technology. This includes developing high-performance lubricants for extreme conditions, environmentally friendly bio-based solutions, and sensor-enabled lubricants that provide real-time performance data. -

Strategic Acquisitions: Mergers and acquisitions are a common tactic for expanding product portfolios and geographical reach. Recent examples include ExxonMobil's acquisition of JMH Lubricants and TotalEnergies' purchase of Hutchinson's industrial lubrication business. -

Customer-Centric Approach: Players are tailoring their offerings to specific industries and applications. This involves collaborating with equipment manufacturers, offering customized lubrication solutions, and providing comprehensive maintenance services. -

Digital Transformation: Embracing digital tools like predictive maintenance and e-commerce platforms is enhancing efficiency, cost-effectiveness, and customer engagement.

Factors Determining Market Share:

-

Brand Reputation: Established brands with a proven track record in reliability and performance hold a significant advantage. -

Technological Expertise: The ability to offer innovative and specialized lubricants that cater to specific needs is crucial for differentiation. -

Global Presence: A strong geographical footprint with robust distribution networks is vital for reaching a wider customer base. -

Sustainability Focus: The growing demand for environmentally friendly lubricants is putting pressure on companies to adopt sustainable practices and develop bio-based solutions.

Key Players

-

Petrochina Company Limited

-

Total S.A

-

Sinopec Limited

-

LUKOIL

-

BP Plc

-

Chevron Corporation

-

Fuchs Petrolub

-

ExxonMobil Corporation

-

Royal Dutch Shell

-

Idemitsu Kosan Co Ltd

Recent Developments :

January 2022: Chevron Lubricants Lanka PLC, a subsidiary of Chevron Corporation, announced a marketing deal with Rock Energy in Bangladesh for its lubricant products.

December 2021: Castrol, BP, and Vietnam National Petroleum Group (Petrolimex) announced the joint venture agreement they had extended for another 20 years, from 2022 to 2042. Castrol BP Petco Co. Ltd is the name of the joint venture company.

March 2024: Environmental concerns take center stage as bio-based lubricants gain traction. ExxonMobil announces a new line of bio-lubricants made from renewable resources, aiming to cater to the growing demand for sustainable solutions in the industrial sector