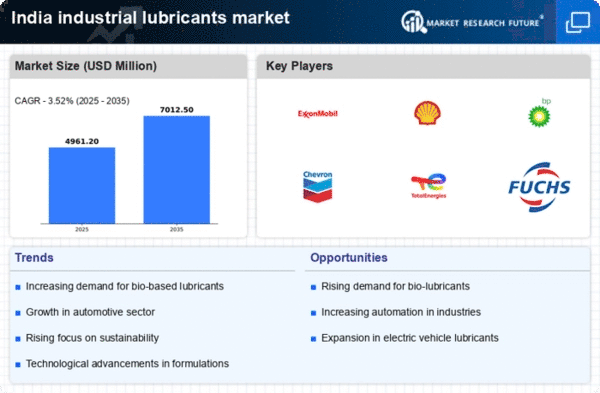

The industrial lubricants market in India is characterized by a competitive landscape that is increasingly shaped by innovation, sustainability, and strategic partnerships. Key players such as ExxonMobil (US), Shell (GB), and BP (GB) are actively pursuing strategies that emphasize technological advancements and eco-friendly product offerings. These companies are not only focusing on expanding their product portfolios but are also investing in digital transformation initiatives to enhance operational efficiency and customer engagement. The collective efforts of these firms contribute to a dynamic market environment where competition is driven by both product differentiation and service excellence.In terms of business tactics, localizing manufacturing and optimizing supply chains appear to be pivotal strategies for many companies. The market structure is moderately fragmented, with several players vying for market share. However, the influence of major corporations like Chevron (US) and TotalEnergies (FR) is substantial, as they leverage their The industrial lubricants market. This competitive structure fosters an environment where innovation and responsiveness to market demands are crucial for success.

In October ExxonMobil (US) announced the launch of a new line of bio-based lubricants aimed at reducing environmental impact. This strategic move not only aligns with global sustainability trends but also positions ExxonMobil as a leader in eco-friendly solutions within the industrial lubricants sector. The introduction of these products is likely to attract environmentally conscious consumers and industries, thereby enhancing ExxonMobil's market share.

In September Shell (GB) expanded its manufacturing capabilities in India by investing in a state-of-the-art facility designed to produce high-performance lubricants. This expansion is significant as it not only increases Shell's production capacity but also allows for greater localization of products, which can lead to reduced lead times and improved customer service. Such investments indicate Shell's commitment to strengthening its operational footprint in the region and responding effectively to local market needs.

In August BP (GB) entered into a strategic partnership with a leading Indian automotive manufacturer to co-develop advanced lubricants tailored for electric vehicles. This collaboration underscores BP's focus on innovation and adaptation to emerging market trends, particularly the shift towards electric mobility. By aligning with a key player in the automotive sector, BP is likely to enhance its competitive positioning and tap into the growing demand for specialized lubricants in the EV market.

As of November the competitive trends in the industrial lubricants market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances are becoming more prevalent, as companies recognize the value of collaboration in driving innovation and enhancing product offerings. Looking ahead, it is anticipated that competitive differentiation will evolve from traditional price-based strategies to a focus on technological advancements, sustainable practices, and reliable supply chains. This shift may redefine the competitive landscape, compelling companies to innovate continuously and adapt to changing consumer preferences.