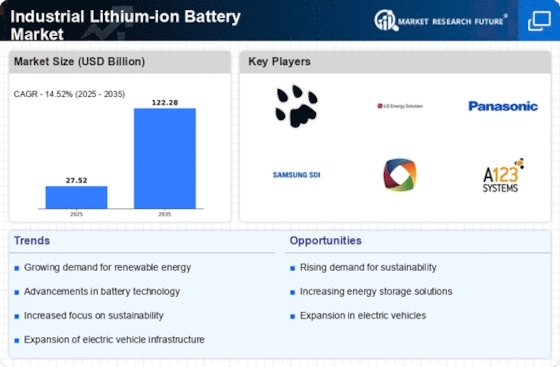

Advancements in Battery Technology

Technological innovations in battery chemistry and design are propelling the Industrial Lithium-ion Battery Market forward. Developments such as solid-state batteries and improved lithium-ion formulations are enhancing performance metrics, including energy density, charging speed, and lifespan. These advancements are likely to attract investments and drive adoption across various industrial sectors. For instance, the introduction of high-capacity batteries could lead to longer operational hours for machinery and equipment, thereby increasing productivity. The market is witnessing a shift towards more efficient and sustainable battery solutions, which could reshape the competitive landscape in the coming years.

Government Incentives and Policies

Government initiatives aimed at promoting clean energy and reducing carbon emissions are influencing the Industrial Lithium-ion Battery Market. Various countries are implementing policies that encourage the adoption of lithium-ion batteries in industrial applications. These incentives may include tax breaks, subsidies, and grants for companies investing in battery technology and renewable energy solutions. Such regulatory frameworks are likely to stimulate market growth by making it more financially viable for industries to transition to lithium-ion battery systems. The alignment of government policies with sustainability goals could further enhance the attractiveness of the industrial battery market.

Growing Focus on Energy Efficiency

The increasing focus on energy efficiency across industries is driving the Industrial Lithium-ion Battery Market. Companies are seeking ways to optimize their energy consumption and reduce operational costs, leading to a heightened interest in advanced battery technologies. Lithium-ion batteries, known for their efficiency and longevity, are becoming a preferred choice for energy storage and management solutions. As industries strive to meet sustainability targets, the demand for energy-efficient systems is expected to rise. This trend may lead to increased investments in battery technology, further propelling the growth of the industrial lithium-ion battery market.

Increased Adoption of Electric Vehicles

The surge in electric vehicle (EV) adoption is significantly impacting the Industrial Lithium-ion Battery Market. As industries transition towards electrification, the demand for high-performance lithium-ion batteries is expected to rise. The automotive sector is increasingly relying on these batteries for their efficiency and lower environmental impact compared to traditional combustion engines. Recent statistics indicate that the EV market is projected to expand rapidly, with a corresponding increase in the need for industrial-grade batteries to support manufacturing and infrastructure. This trend suggests a symbiotic relationship between the EV market and the industrial battery sector, potentially leading to collaborative innovations.

Rising Demand for Renewable Energy Storage

The increasing emphasis on renewable energy sources, such as solar and wind, is driving the Industrial Lithium-ion Battery Market. As these energy sources are intermittent, the need for efficient energy storage solutions becomes paramount. Lithium-ion batteries are favored for their high energy density and efficiency, making them suitable for storing energy generated from renewable sources. According to recent data, the energy storage market is projected to grow significantly, with lithium-ion batteries expected to capture a substantial share. This trend indicates a robust demand for industrial applications, as companies seek to enhance their energy management systems and reduce reliance on fossil fuels.