Market Trends

Key Emerging Trends in the Industrial Insulation Market

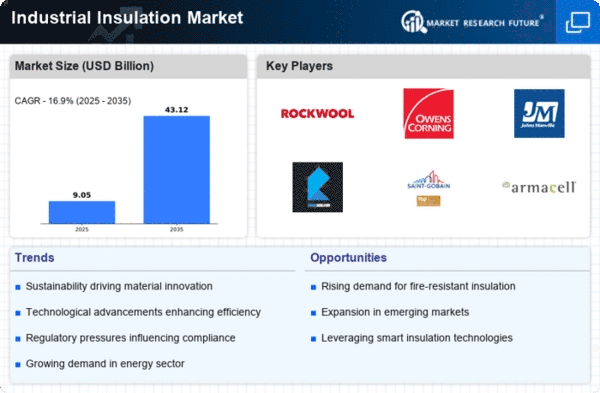

The industrial insulation market is witnessing several notable trends that are shaping its trajectory and influencing the dynamics of the sector. One significant trend is the increasing emphasis on energy efficiency and sustainability across industries worldwide. As companies seek to reduce energy consumption, minimize greenhouse gas emissions, and comply with stringent environmental regulations, there is a growing demand for high-performance insulation materials that offer superior thermal efficiency and contribute to overall energy savings. This trend is driving the adoption of advanced insulation solutions in sectors such as manufacturing, oil and gas, chemical processing, and construction, where energy-intensive operations require effective thermal management solutions.

The major restraining factor of the Industrial Insulation Market is less awareness regarding the usage of insulation products. Therefore, the lack of awareness related to the benefits of proper insulation is a major constraint for the market. The increasing use of renewables for electricity generation is another factor that is restraining the market's growth.

Moreover, there is a notable shift towards the use of eco-friendly and sustainable insulation materials in response to growing environmental concerns. With increasing awareness about the environmental impact of conventional insulation materials such as fiberglass and foam plastics, there is a rising demand for alternative options that are recyclable, biodegradable, and have low embodied carbon. Sustainable insulation materials derived from renewable sources, such as cellulose, wool, hemp, and recycled materials, are gaining traction as companies prioritize environmentally responsible building practices and seek to reduce their carbon footprint.

Another key trend in the industrial insulation market is the focus on enhanced performance and durability of insulation systems. With industries operating in harsh and demanding environments, there is a growing need for insulation materials that can withstand extreme temperatures, moisture, corrosion, and mechanical stress while maintaining their thermal efficiency over the long term. As a result, manufacturers are investing in research and development to develop innovative insulation solutions with improved fire resistance, moisture resistance, acoustic insulation properties, and resistance to chemicals and pollutants.

Furthermore, the market is witnessing a growing demand for insulation solutions tailored to specific applications and industries. Different sectors have unique insulation requirements based on factors such as temperature range, operating conditions, space constraints, and regulatory standards. This trend has led to the development of specialized insulation products and systems designed to meet the diverse needs of industries such as petrochemicals, pharmaceuticals, food and beverage, power generation, and HVAC (heating, ventilation, and air conditioning). Customized insulation solutions offer improved performance, reliability, and efficiency, providing companies with a competitive edge in their respective markets.

Additionally, the industrial insulation market is experiencing significant growth in emerging economies, driven by rapid industrialization, urbanization, and infrastructure development. Countries in Asia-Pacific, Latin America, and the Middle East are witnessing increasing investments in manufacturing facilities, commercial buildings, and infrastructure projects, creating a growing demand for insulation materials and solutions. This trend presents lucrative opportunities for insulation manufacturers and suppliers to expand their presence in these markets, forge strategic partnerships, and capitalize on the growing demand for energy-efficient and sustainable building materials.

Moreover, advancements in insulation technologies and installation techniques are driving innovation and evolution in the industrial insulation market. New developments in aerogel insulation, vacuum insulation panels, phase change materials, and prefabricated insulation systems are enabling improved thermal performance, space savings, and ease of installation. Additionally, digitalization and the adoption of Building Information Modeling (BIM) are enhancing the design, planning, and implementation of insulation projects, optimizing energy efficiency and reducing lifecycle costs for end-users.

Leave a Comment