Market Analysis

In-depth Analysis of Industrial Insulation Market Industry Landscape

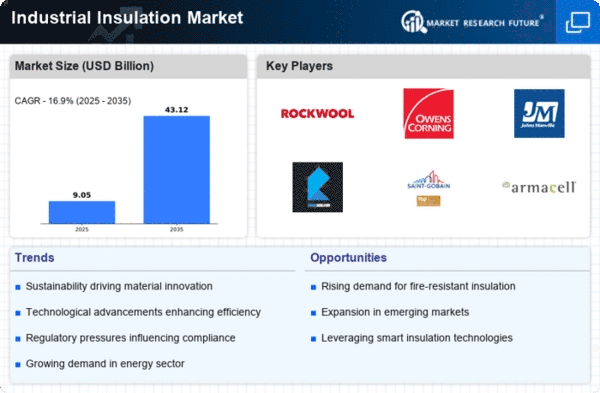

The industrial insulation market operates within a dynamic environment influenced by various factors that shape its growth and competitiveness. Industrial insulation is vital for maintaining temperature control, energy efficiency, and safety across diverse sectors such as manufacturing, oil and gas, chemicals, and construction. One of the primary drivers of market dynamics is the increasing emphasis on energy efficiency and sustainability. Governments worldwide are implementing stringent regulations to curb greenhouse gas emissions and promote energy conservation, leading industries to invest in insulation solutions to minimize heat loss and reduce energy consumption. This growing focus on sustainability is driving the demand for advanced insulation materials and technologies, thereby propelling market growth.

The challenges are delaying the growth process of the Industrial Insulation Market. Challenges like high installation cost and lack of skilled workforce are the challenging factors of the market. The cost of installation of insulation materials is quite expensive due to the need for separate clearances and skilled labor. The efficiency of the insulation material and its heat resistance property depends on the method of installation. Both knowledge and experience are necessary for achieving proper insulation in tanks, equipment, pipes, and boilers. Improper insulation of fittings, tanks, boilers, and other types of machinery could result in high energy losses and may cost high charges annually. These are the major challenging factors of the market.

Technological advancements play a crucial role in shaping the competitive landscape of the industrial insulation market. Manufacturers are continually innovating to develop insulation materials with enhanced thermal performance, durability, and ease of installation. Innovations such as aerogel-based insulation, vacuum insulation panels, and advanced foams are gaining traction due to their superior insulating properties and space-saving designs. Additionally, the integration of smart technologies for monitoring and optimizing insulation performance is becoming increasingly prevalent, offering opportunities for market players to differentiate their products and cater to evolving customer needs.

Market dynamics are also influenced by economic factors such as industrialization, infrastructure development, and construction activities. Rapid industrialization in emerging economies, particularly in Asia-Pacific and Latin America, is driving the demand for industrial insulation across various sectors, including manufacturing, petrochemicals, and power generation. Furthermore, infrastructure projects such as the construction of commercial buildings, residential complexes, and transportation facilities require effective insulation solutions to meet energy efficiency standards and regulatory requirements. Economic fluctuations, currency exchange rates, and government spending on infrastructure projects can impact market growth and investment decisions within the industrial insulation sector.

Environmental regulations and sustainability concerns are increasingly shaping the market dynamics of industrial insulation. With a growing emphasis on reducing carbon emissions and minimizing environmental impact, industries are seeking insulation materials that are eco-friendly, recyclable, and energy-efficient. This has led to the development and adoption of sustainable insulation solutions such as natural fibers, recycled materials, and bio-based foams. Manufacturers are also investing in research and development to improve the environmental performance of their products and comply with evolving regulations, thereby driving innovation and market growth in the sustainable insulation segment.

The competitive dynamics within the industrial insulation market are characterized by intense rivalry among key players vying for market share and profitability. Market participants are adopting strategies such as mergers, acquisitions, partnerships, and product diversification to strengthen their foothold in the market and expand their product portfolios. Additionally, pricing strategies, product differentiation, and customer service initiatives are employed to gain a competitive edge and retain customers in a highly competitive environment. Market consolidation is also a prominent trend, with larger players acquiring smaller firms to enhance their market presence and technological capabilities.

Customer preferences and industry trends are significant drivers of market dynamics in the industrial insulation sector. End-users are increasingly prioritizing factors such as performance, reliability, durability, and cost-effectiveness when selecting insulation solutions for their applications. Industry trends such as modular construction, retrofitting of existing buildings, and the adoption of energy-efficient building codes are driving the demand for innovative insulation materials and technologies. Furthermore, the growing focus on indoor environmental quality and occupant comfort is influencing insulation choices, with an emphasis on materials that provide both thermal insulation and acoustic insulation properties.

Leave a Comment