Global Trade Dynamics

The Industrial Grade Urea Market is significantly impacted by global trade dynamics, including supply chain fluctuations and international pricing trends. In 2025, the interconnectedness of markets means that changes in one region can have ripple effects across the globe. For instance, fluctuations in natural gas prices, a key feedstock for urea production, can influence production costs and, consequently, market prices. Additionally, trade policies and tariffs can affect the availability of urea in various regions, creating opportunities and challenges for manufacturers. As countries seek to secure their fertilizer supplies, the Industrial Grade Urea Market may experience shifts in trade patterns, potentially leading to increased competition and innovation among producers. This dynamic environment necessitates adaptability and strategic planning for stakeholders within the market.

Environmental Regulations

The Industrial Grade Urea Market is also influenced by stringent environmental regulations aimed at reducing nitrogen emissions. Governments across various regions are implementing policies that encourage the use of cleaner and more efficient fertilizers. Urea, being a nitrogen-rich compound, is often favored due to its lower environmental impact compared to other nitrogen fertilizers. In 2025, it is anticipated that regulatory frameworks will continue to evolve, promoting the use of urea as a sustainable option for agricultural practices. This shift not only aligns with The Industrial Grade Urea Industry favorably, as manufacturers adapt to meet these regulatory demands. The emphasis on eco-friendly products may lead to increased investments in urea production technologies, further enhancing the market's growth potential.

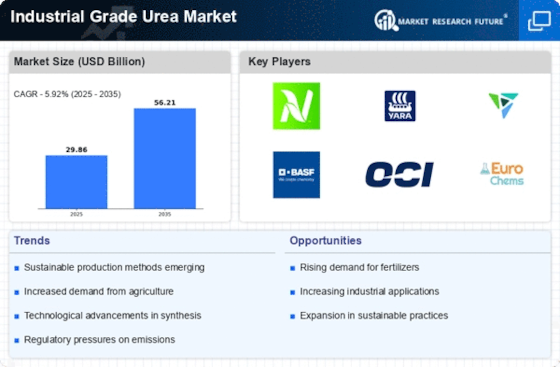

Rising Agricultural Demand

The Industrial Grade Urea Market is experiencing a surge in demand driven by the increasing need for fertilizers in agriculture. As the global population continues to grow, the pressure on food production intensifies, leading to a heightened requirement for nitrogen-based fertilizers, particularly urea. In 2025, the agricultural sector is projected to account for a substantial portion of urea consumption, with estimates suggesting that around 70% of industrial-grade urea is utilized in this sector. This trend indicates a robust growth trajectory for the Industrial Grade Urea Market, as farmers seek to enhance crop yields and ensure food security. Furthermore, the adoption of advanced farming techniques and precision agriculture is likely to further bolster the demand for high-quality urea fertilizers, thereby reinforcing the market's expansion.

Diversification of End-Use Applications

The Industrial Grade Urea Market is witnessing a diversification of end-use applications beyond traditional agricultural uses. Industries such as automotive, pharmaceuticals, and chemical manufacturing are increasingly utilizing industrial-grade urea for various purposes, including the production of adhesives, resins, and as a reducing agent in selective catalytic reduction systems. This diversification is expected to contribute to the market's growth, as it opens new avenues for urea consumption. In 2025, the automotive sector, in particular, is projected to drive demand for urea-based solutions, as stricter emissions regulations necessitate the use of urea in diesel engines. This trend indicates a broader acceptance of industrial-grade urea across multiple sectors, thereby enhancing the overall market landscape.

Technological Innovations in Production

Technological advancements in the production of industrial-grade urea are significantly shaping the Industrial Grade Urea Market. Innovations such as the development of more efficient synthesis processes and the integration of automation in manufacturing are enhancing production capabilities. In 2025, it is expected that these technological improvements will lead to reduced production costs and increased output, thereby making urea more accessible to various industries. Additionally, the implementation of smart manufacturing techniques may optimize resource utilization, further driving the market's growth. As companies strive to enhance their competitive edge, investments in research and development are likely to increase, fostering a more dynamic Industrial Grade Urea Market that can respond effectively to changing consumer demands.