Top Industry Leaders in the Industrial Control System Security Market

*Disclaimer: List of key companies in no particular order

The Competitive Landscape of the Industrial Control System (ICS) Security Market

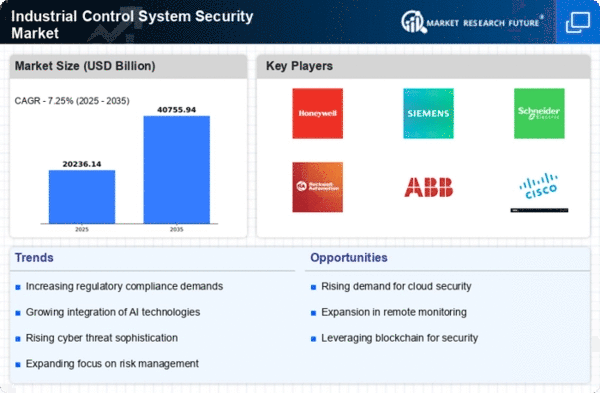

The Industrial Control System (ICS) security market, stands as the vigilant sentinel safeguarding the critical arteries of our industrialized world. Protecting power grids, water treatment plants, and manufacturing facilities from cyber threats demands robust solutions and a clear understanding of the competitive landscape. Understanding the competitive landscape in this dynamic market is crucial for ensuring the uninterrupted flow of vital resources and safeguarding against potential threats.

Some of the Industrial Control System (ICS) Security companies listed below:

- Rockwell Automation Inc.

- BAE Systems

- Schneider Electric

- ABB (Switzerland)

- Fortinet Inc.

- Cisco Systems Inc.

- Belden Inc.

- Siemens AG

- Check Point Software Technologies Ltd.

- Honeywell International

- AO Kaspersky

Strategies Adopted by Leaders

- Technological Prowess: Industry leaders like Fortinet, Palo Alto Networks, and Rockwell Automation invest heavily in R&D, pioneering advanced threat detection algorithms, network segmentation technologies, and intrusion prevention systems. They integrate cutting-edge technologies like artificial intelligence (AI), machine learning (ML), and blockchain to offer comprehensive and proactive protection.

- Vertical Focus: Leading players cater to specific industry segments. Dragos Security excels in protecting energy and utilities infrastructure, while Honeywell focuses on industrial automation and manufacturing. This specialization allows for deeper technical expertise and tailored solutions for each industry's unique vulnerabilities and regulations.

- Software and Service Integration: Offering comprehensive software suites for network monitoring, vulnerability assessment, and incident response expands value propositions and fosters customer loyalty. Companies like CyberArk and Trend Micro provide robust software tools and reliable cybersecurity consulting services.

- Global Presence: Establishing geographically diverse sales and service networks is crucial for supporting a globalized industrial landscape. Cisco and Siemens maintain strong regional presence across continents, ensuring proximity to clients and efficient incident response capabilities.

- Strategic Partnerships: Collaborations with industrial automation vendors, system integrators, and government agencies accelerate technology adoption and broaden market reach. For instance, partnerships between ICS security providers and industrial equipment manufacturers enable integration of security features within control systems themselves.

Factors for Market Share Analysis:

- Security Solution Type: Analyzing market share by solution type (network security, endpoint security, vulnerability management) reveals dominant players in each segment and future growth potential. Network security remains the largest segment due to its broad applicability, while endpoint security is gaining traction with the increasing adoption of smart devices and distributed control systems.

- Industry Segment: Understanding the needs of different end-user segments (energy, utilities, manufacturing, transportation) is key. Energy and utilities prioritize high-availability and grid stability, while manufacturing demands flexible security solutions adaptable to diverse production environments.

- Deployment Mode: Analyzing market share by deployment mode (on-premises, cloud-based) helps identify leaders in each segment and future trends. On-premises solutions offer greater control and data privacy, while cloud-based solutions provide scalability and remote access capabilities.

New and Emerging Companies:

- CrowdStrike: This cybersecurity firm leverages its extensive cloud-based threat intelligence platform to offer advanced ICS threat detection and incident response solutions, providing real-time visibility and rapid response capabilities.

- Nozomi Networks: This Israeli startup specializes in deep packet inspection technology for ICS networks, offering granular visibility into industrial communication protocols and enabling detection of sophisticated cyberattacks targeting these systems.

- CyberX: This Singaporean company focuses on securing industrial IoT (IIoT) devices and edge computing platforms, providing comprehensive solutions for protecting the increasingly connected industrial landscape.

Industry Developments:

In a Series D round extension led by WestCap, Dragos, a firm that develops software to safeguard the control systems for manufacturing and industrial equipment, raised $74 million in 2023. Dragos has now raised $440 million in total, and the startup's post-money valuation has remained at $1.7 billion for the past two years.

The new website, www.spiroflowautomation.com, was created in 2023 by Spiroflow Automation, a top full-service industrial control, networking, and automation company. Customers seeking essential information on factory automation and advanced industrial control systems for manufacturing and industrial facilities benefit from an improved user experience provided by the new digital environment.