Rising Demand in Healthcare Sector

The healthcare sector in India is experiencing a notable surge in demand for advanced diagnostic and therapeutic solutions. This trend is likely to drive the transfer membrane market, as these membranes are essential in various applications, including filtration and separation processes in laboratories and hospitals. The increasing prevalence of chronic diseases and the need for efficient diagnostic tools are contributing to this growth. According to recent estimates, the healthcare expenditure in India is projected to reach $372 B by 2022, indicating a robust market for medical technologies. As healthcare facilities expand and modernize, the transfer membrane market is expected to benefit significantly from this rising demand.

Growth in Water Treatment Initiatives

India's water scarcity issues have prompted the government and private sectors to invest heavily in water treatment technologies. The transfer membrane market is poised to gain from this focus, as membranes play a crucial role in desalination, wastewater treatment, and purification processes. With the Indian government aiming to provide clean drinking water to all citizens, the demand for efficient filtration systems is likely to increase. Reports suggest that the water treatment market in India could reach $2.5 B by 2025, highlighting the potential for growth in the transfer membrane market as industries seek sustainable solutions to address water quality challenges.

Expansion of Food and Beverage Industry

The food and beverage industry in India is witnessing rapid expansion, driven by changing consumer preferences and increasing disposable incomes. This growth is likely to impact the transfer membrane market positively, as these membranes are utilized in various applications, including food processing, beverage filtration, and dairy production. The demand for high-quality, safe, and preservative-free products is pushing manufacturers to adopt advanced filtration technologies. The food processing sector is expected to grow at a CAGR of 11% from 2020 to 2025, suggesting a substantial opportunity for the transfer membrane market to cater to the evolving needs of this industry.

Increased Investment in Research and Development

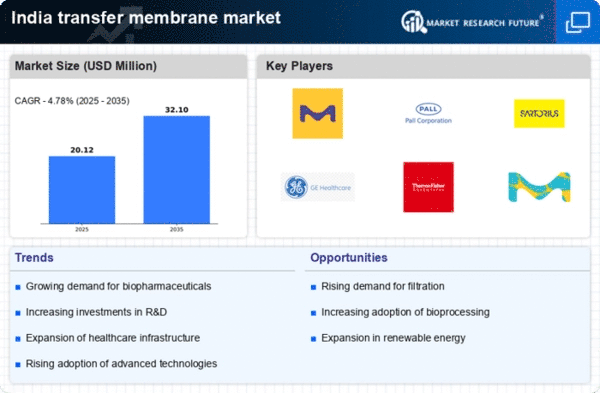

Investment in research and development (R&D) within the Indian transfer membrane market is on the rise, driven by both public and private sectors. This focus on R&D is likely to foster innovation and improve the quality and efficiency of membrane technologies. Government initiatives aimed at promoting scientific research and collaboration with academic institutions are expected to yield advancements in membrane applications. As companies strive to develop cutting-edge solutions to meet market demands, the transfer membrane market stands to benefit from these investments. The emphasis on R&D could lead to breakthroughs that enhance the competitive landscape and drive market growth.

Technological Innovations in Membrane Production

Innovations in membrane technology are transforming the transfer membrane market, particularly in India. Advances in materials science and engineering are leading to the development of more efficient and durable membranes. These innovations are likely to enhance the performance of membranes in various applications, including biotechnology and pharmaceuticals. The introduction of nanotechnology and smart membranes could further revolutionize the market, offering improved selectivity and permeability. As industries seek to optimize their processes and reduce costs, the demand for advanced membrane solutions is expected to rise, indicating a promising future for the transfer membrane market.