Increase in Geriatric Population

The demographic shift towards an aging population in India is a significant factor influencing the tachycardia market. As the elderly population grows, the incidence of age-related health issues, including tachycardia, is expected to rise. Reports indicate that individuals aged 60 and above are at a higher risk of developing cardiovascular conditions, which necessitates specialized care and monitoring. This demographic trend is likely to drive demand for tachycardia management solutions, as healthcare systems adapt to cater to the needs of older patients. Furthermore, the government’s focus on geriatric healthcare may lead to increased funding and resources allocated to the tachycardia market, fostering further growth opportunities.

Growing Awareness of Heart Health

There is a notable increase in public awareness regarding heart health in India, which significantly impacts the tachycardia market. Educational campaigns and health programs have been instrumental in informing the population about the risks associated with tachycardia and other heart conditions. This heightened awareness is leading to more individuals seeking medical advice and diagnostic services. As a result, healthcare providers are experiencing a surge in patient consultations related to tachycardia. Market data suggests that the demand for cardiac monitoring devices and treatment options is likely to grow by approximately 15% annually as more people prioritize their heart health. This trend indicates a promising outlook for the tachycardia market, as it aligns with the broader movement towards preventive healthcare.

Advancements in Medical Technology

Technological innovations in medical devices and treatment methodologies are transforming the tachycardia market in India. The introduction of advanced cardiac monitoring systems, such as wearable devices and mobile health applications, is enhancing the ability to detect and manage tachycardia effectively. These technologies not only improve patient outcomes but also facilitate remote monitoring, which is becoming increasingly important in the current healthcare landscape. Market analysts project that the integration of artificial intelligence and machine learning in cardiac care could lead to a 20% increase in the efficiency of tachycardia management. As healthcare providers adopt these cutting-edge technologies, the tachycardia market is poised for substantial growth, driven by the demand for innovative solutions.

Rising Incidence of Cardiovascular Diseases

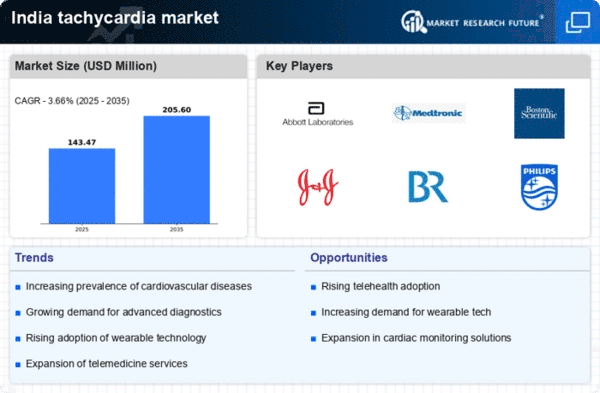

The increasing prevalence of cardiovascular diseases in India is a primary driver for the tachycardia market. According to recent health reports, cardiovascular diseases account for approximately 28% of all deaths in the country. This alarming statistic highlights the urgent need for effective monitoring and treatment options for conditions like tachycardia. As more individuals are diagnosed with heart-related issues, the demand for tachycardia management solutions is expected to rise. Healthcare providers are likely to invest in advanced diagnostic tools and treatment modalities, thereby propelling the growth of the tachycardia market. Furthermore, the Indian government's initiatives to improve healthcare infrastructure may also contribute to the expansion of this market, as more facilities become equipped to handle such conditions.

Regulatory Support for Cardiac Health Initiatives

The Indian government is actively promoting initiatives aimed at improving cardiac health, which serves as a catalyst for the tachycardia market. Regulatory bodies are implementing policies that encourage research and development in cardiac care, as well as the establishment of specialized cardiac units in hospitals. This support is likely to enhance the availability of advanced treatment options for tachycardia patients. Additionally, public health campaigns aimed at reducing the burden of cardiovascular diseases are expected to increase the demand for tachycardia management solutions. As a result, the market may experience a growth rate of approximately 12% over the next few years, driven by these supportive regulatory measures.