Cost Efficiency in Operations

Cost efficiency remains a critical driver for the smart contracts-healthcare market, particularly in a price-sensitive environment like India. By automating processes such as claims management and billing, smart contracts can significantly reduce administrative costs. The healthcare sector in India has been grappling with high operational costs, which can account for up to 30% of total expenditures. Smart contracts streamline these processes, potentially leading to savings that can be redirected towards patient care. As healthcare providers look to optimize their operations, the adoption of smart contracts is expected to rise, thereby propelling the growth of the smart contracts-healthcare market.

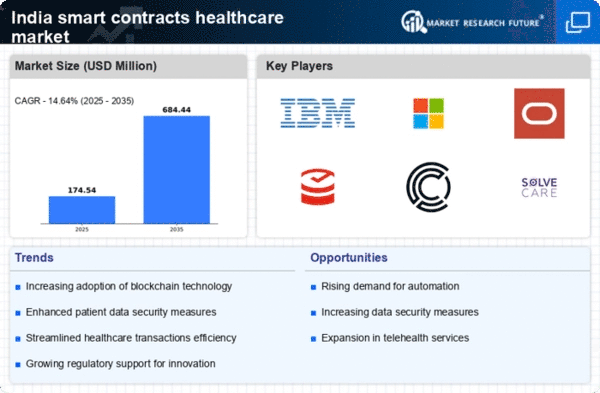

Rise of Telemedicine Services

The rise of telemedicine services in India is driving the smart contracts-healthcare market forward. With the increasing acceptance of remote consultations, there is a growing need for secure and efficient transaction methods. Smart contracts can facilitate seamless interactions between patients and healthcare providers, ensuring that agreements are executed automatically upon meeting predefined conditions. This is particularly relevant in a country where telemedicine usage has surged, with reports indicating a 200% increase in consultations over the past year. As telemedicine continues to expand, the smart contracts-healthcare market is likely to benefit from the integration of these technologies.

Growing Demand for Transparency

The increasing demand for transparency in healthcare transactions is a pivotal driver for the smart contracts-healthcare market. Stakeholders, including patients and providers, are seeking assurance regarding the integrity of data and the authenticity of transactions. Smart contracts facilitate this by providing immutable records that can be audited in real-time. In India, where healthcare fraud has been a concern, the implementation of smart contracts could potentially reduce discrepancies and enhance trust. According to recent estimates, the healthcare fraud rate in India could be as high as 10%, underscoring the need for transparent systems. As the healthcare sector continues to evolve, the smart contracts-healthcare market is likely to see significant growth fueled by this demand for transparency.

Increased Focus on Data Security

The heightened focus on data security in healthcare is a crucial driver for the smart contracts-healthcare market. With the rise in cyber threats and data breaches, healthcare organizations in India are prioritizing secure data management solutions. Smart contracts offer a decentralized approach to data storage, which can mitigate risks associated with centralized databases. The Indian healthcare sector has witnessed a surge in data breaches, prompting a shift towards more secure technologies. As organizations seek to protect sensitive patient information, the smart contracts-healthcare market is likely to experience increased adoption, driven by the need for enhanced data security.

Regulatory Support for Digital Solutions

Regulatory support for digital solutions in healthcare is emerging as a significant driver for the smart contracts-healthcare market. The Indian government has been actively promoting digital health initiatives, which include the use of blockchain technology for secure data management. Recent policy frameworks suggest a favorable environment for the adoption of smart contracts, as they align with the government's vision of a digital healthcare ecosystem. This regulatory backing could potentially enhance the credibility and acceptance of smart contracts among healthcare providers and patients alike. As the regulatory landscape evolves, the smart contracts-healthcare market is poised for growth.