Advent of E-commerce

The rise of e-commerce platforms in India has transformed the way consumers access products, including portable water purifiers. With the increasing penetration of the internet and smartphones, consumers can now easily compare products, read reviews, and make informed purchasing decisions online. E-commerce sales of portable water purifiers have surged, with estimates suggesting a growth rate of over 30% annually in this segment. This trend indicates that the convenience of online shopping is likely to enhance the visibility and accessibility of portable water purifiers, thereby stimulating market growth. The portable water-purifier market stands to benefit significantly from this shift in consumer purchasing behavior.

Environmental Concerns

Environmental concerns regarding water pollution and scarcity are increasingly influencing consumer behavior in India. The awareness of the detrimental effects of contaminated water sources has led to a growing preference for portable water purifiers. As pollution levels rise, particularly in urban areas, consumers are seeking reliable solutions to ensure safe drinking water. Reports indicate that nearly 70% of India's surface water is contaminated, which underscores the urgency for effective purification methods. This heightened awareness of environmental issues is likely to drive the portable water-purifier market, as individuals look for sustainable and efficient ways to access clean water.

Government Initiatives

Government initiatives aimed at improving water quality and accessibility are pivotal in driving the portable water-purifier market. Various programs and schemes have been launched to promote safe drinking water, particularly in rural and semi-urban areas. For instance, the National Rural Drinking Water Programme (NRDWP) emphasizes the importance of clean water access, which indirectly boosts the demand for portable purifiers. The government's focus on providing subsidies for water purification technologies may further enhance market growth. As a result, the portable water-purifier market is likely to benefit from these supportive policies, encouraging consumers to adopt portable solutions for their water needs.

Increasing Urbanization

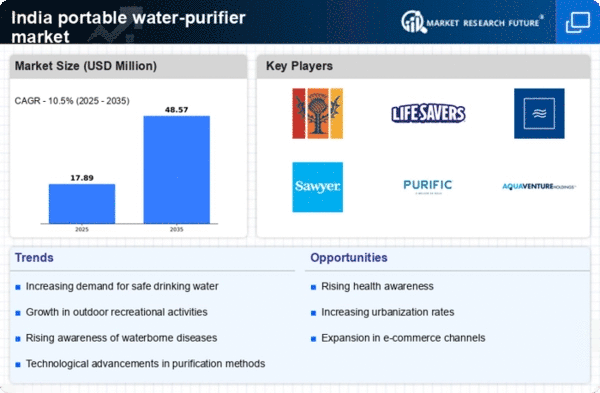

The rapid urbanization in India is a crucial driver for the portable water-purifier market. As more individuals migrate to urban areas, the demand for clean drinking water intensifies. Urban centers often face challenges related to water quality, leading to a heightened awareness of the need for portable purification solutions. According to recent data, urban populations in India are projected to reach 600 million by 2031, which could significantly increase the market for portable water purifiers. This trend suggests that consumers are likely to invest in portable solutions to ensure access to safe drinking water, thereby propelling the growth of the portable water-purifier market.

Rising Disposable Incomes

The increase in disposable incomes among the Indian population is another significant driver for the portable water-purifier market. As economic conditions improve, consumers are more willing to invest in health and wellness products, including water purification systems. Data indicates that the middle-class segment is expanding, with an estimated 300 million people expected to enter this category by 2030. This demographic shift suggests a growing market for portable water purifiers, as consumers prioritize health and safety. The willingness to spend on quality products may lead to a surge in demand for portable water purifiers, thereby positively impacting the market.