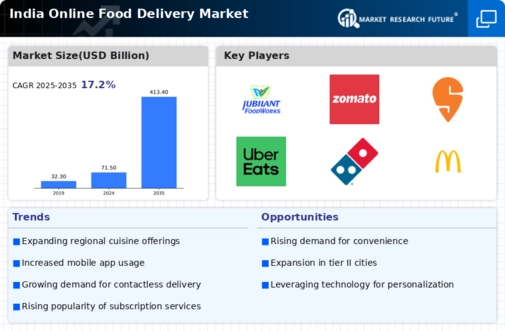

The online food-delivery market in India is characterized by a dynamic competitive landscape, driven by rapid technological advancements and evolving consumer preferences. Major players such as Zomato (IN), Swiggy (IN), and Uber Eats (US) are at the forefront, each adopting distinct strategies to capture market share. Zomato (IN) has focused on expanding its service offerings beyond food delivery, venturing into grocery delivery and subscription services, thereby enhancing customer engagement. Swiggy (IN), on the other hand, emphasizes hyperlocal delivery and has invested in AI-driven logistics to optimize delivery times. Uber Eats (US) appears to be leveraging its The online food-delivery market, such as cashless payments and personalized recommendations, which collectively intensify competition among these players.

The market structure is moderately fragmented, with several regional and national players competing alongside international giants. Key business tactics include localizing services to cater to diverse consumer tastes and optimizing supply chains to ensure timely deliveries. The collective influence of these major players shapes a competitive environment where agility and responsiveness to consumer demands are paramount.

In October 2025, Zomato (IN) announced a strategic partnership with a leading grocery chain to enhance its delivery capabilities, allowing customers to order groceries alongside meals. This move is significant as it positions Zomato (IN) to tap into the growing demand for convenience, potentially increasing its market penetration and customer loyalty. Furthermore, this partnership may serve as a model for future collaborations within the sector, indicating a trend towards integrated service offerings.

In September 2025, Swiggy (IN) launched a new AI-driven feature that predicts customer preferences based on previous orders, aiming to enhance user experience and increase order frequency. This initiative underscores the importance of technology in driving customer engagement and retention, suggesting that Swiggy (IN) is keen on leveraging data analytics to refine its service delivery.

In November 2025, Uber Eats (US) expanded its operations in tier-2 cities, introducing a localized marketing campaign to attract new users. This strategic expansion reflects a growing trend of urbanization and increased disposable income in these regions, indicating that Uber Eats (US) is positioning itself to capitalize on emerging markets within India.

As of November 2025, current trends in the online food-delivery market include a pronounced shift towards digitalization, sustainability, and the integration of AI technologies. Strategic alliances are increasingly shaping the competitive landscape, as companies seek to enhance their service offerings and operational efficiencies. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technology integration, and supply chain reliability, as players strive to meet the changing demands of consumers.

Leave a Comment