Rising Cancer Incidence

The increasing incidence of cancer in India is a primary driver for the oncology information-systems market. According to the National Cancer Registry Programme, cancer cases are projected to rise significantly, with an estimated 1.5 million new cases expected annually by 2025. This alarming trend necessitates advanced information systems to manage patient data, treatment protocols, and outcomes effectively. As healthcare providers strive to enhance their capabilities in oncology, the demand for sophisticated information systems that can streamline operations and improve patient care is likely to grow. The oncology information-systems market is thus positioned to expand as hospitals and clinics invest in technology to address the rising burden of cancer.

Government Initiatives and Funding

Government initiatives aimed at improving cancer care in India are likely to bolster the oncology information-systems market. The Indian government has launched various programs to enhance cancer treatment facilities and increase awareness. For instance, the National Health Mission allocates substantial funding for cancer care, which includes the adoption of advanced information systems. This financial support encourages healthcare institutions to invest in technology that can improve patient management and treatment outcomes. As a result, the oncology information-systems market is expected to benefit from these initiatives, leading to increased adoption of innovative solutions that enhance operational efficiency and patient care.

Growing Demand for Personalized Medicine

The shift towards personalized medicine in oncology is influencing the oncology information-systems market. As treatment approaches become more tailored to individual patient profiles, the need for sophisticated data management systems that can analyze genetic information and treatment responses is becoming critical. Healthcare providers are increasingly recognizing the importance of integrating genomic data into their treatment plans, which necessitates advanced information systems capable of handling complex datasets. This trend indicates a growing market for oncology information systems that can support personalized treatment strategies, thereby enhancing patient outcomes and driving market growth.

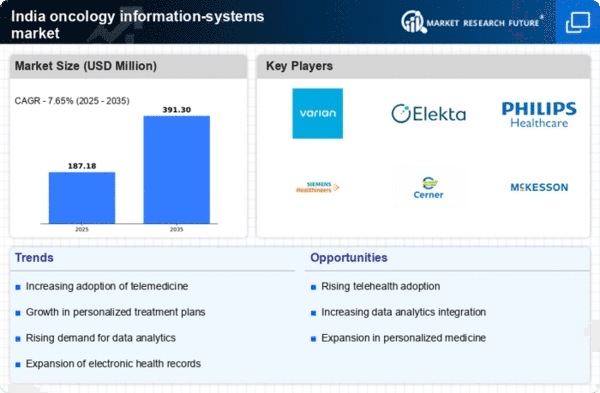

Technological Advancements in Healthcare

Technological advancements in healthcare are driving the growth of the oncology information-systems market. Innovations such as telemedicine, electronic health records, and data analytics are transforming how cancer care is delivered in India. The integration of these technologies allows for better data management, improved patient tracking, and enhanced communication among healthcare providers. As hospitals and clinics adopt these technologies, the demand for comprehensive oncology information systems that can support these advancements is likely to increase. This trend suggests a robust growth trajectory for the oncology information-systems market as healthcare providers seek to leverage technology to improve cancer care.

Increased Focus on Research and Development

The heightened focus on research and development in oncology is a significant driver for the oncology information-systems market. With numerous clinical trials and research initiatives underway, there is a pressing need for robust information systems that can manage vast amounts of data generated from these studies. Research institutions and pharmaceutical companies are investing heavily in R&D to discover new therapies and improve existing ones. This investment creates a demand for specialized oncology information systems that can facilitate data collection, analysis, and reporting. Consequently, the oncology information-systems market is likely to experience growth as it supports the evolving landscape of cancer research.