Increase in Startups and SMEs

The rise of startups and small to medium enterprises (SMEs) in India is a significant driver of the office furniture market. As these businesses emerge, they require functional and aesthetically pleasing office environments to foster innovation and collaboration. The demand for affordable yet stylish office furniture is on the rise, as startups often operate on limited budgets. This segment is projected to contribute to a substantial portion of the market growth, with estimates suggesting an increase of around 15% in demand for office furniture tailored to the needs of startups by 2025. Consequently, manufacturers are focusing on creating cost-effective solutions that do not compromise on quality, thereby enhancing their market presence.

Rising Demand for Modern Workspaces

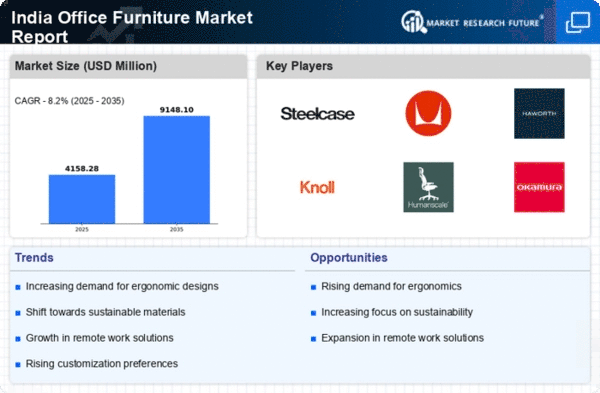

The office furniture market in India is experiencing a notable shift towards modern workspaces, driven by the evolving nature of work. Companies are increasingly investing in contemporary office designs that promote collaboration and creativity. This trend is reflected in the growing demand for modular furniture solutions, which allow for flexible configurations. According to recent data, the market for office furniture is projected to grow at a CAGR of approximately 8% over the next five years. This growth is indicative of a broader transformation in workplace environments, where aesthetics and functionality are paramount. As organizations seek to attract and retain talent, the emphasis on modern office furniture becomes a critical factor in creating an appealing work atmosphere.

Technological Advancements in Furniture

Technological innovations are significantly influencing the office furniture market in India. The integration of smart technology into furniture design is becoming increasingly prevalent, with features such as built-in charging ports and adjustable desks gaining popularity. This trend aligns with the growing emphasis on enhancing employee productivity and comfort. The market is witnessing a surge in demand for furniture that incorporates technology, which is expected to account for a substantial share of the overall market by 2026. As companies prioritize employee well-being, the adoption of tech-enabled office furniture is likely to reshape the landscape of the office furniture market, making it more dynamic and responsive to user needs.

Focus on Health and Wellness in Workspaces

The growing awareness of health and wellness in the workplace is emerging as a pivotal driver for the office furniture market in India. Organizations are increasingly recognizing the importance of creating environments that promote employee well-being. This trend is leading to a surge in demand for ergonomic furniture solutions designed to reduce physical strain and enhance comfort. Research indicates that companies investing in health-focused office furniture can see a return on investment through increased productivity and reduced absenteeism. As a result, the office furniture market is likely to witness a shift towards products that prioritize health and wellness, reflecting a broader societal trend towards holistic employee care.

Government Initiatives for Infrastructure Development

Government initiatives aimed at infrastructure development are playing a crucial role in shaping the office furniture market in India. Programs designed to enhance urban infrastructure and promote business growth are leading to increased investments in commercial real estate. As new office spaces are developed, the demand for office furniture is expected to rise correspondingly. Recent reports indicate that the commercial real estate sector is projected to grow by 10% annually, which will likely drive the office furniture market as businesses seek to furnish new spaces. This synergy between government policies and market demand creates a favorable environment for furniture manufacturers, encouraging innovation and expansion.