Growing Geriatric Population

India's demographic shift towards an aging population is significantly impacting the mobile radiography-systems market. By 2025, it is estimated that the geriatric population will constitute about 10% of the total population, leading to a higher prevalence of chronic diseases that require regular imaging. Mobile radiography systems offer a convenient solution for elderly patients who may have mobility issues, allowing for timely diagnosis and treatment. The demand for these systems is likely to increase as healthcare providers seek to cater to the needs of this demographic. Additionally, the integration of mobile radiography systems in home healthcare services is expected to gain traction, further driving market growth. This trend indicates a shift towards more accessible healthcare solutions, aligning with the needs of an aging population.

Rising Healthcare Expenditure

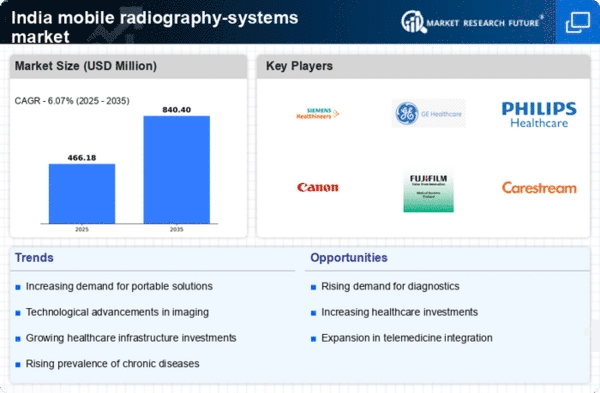

The mobile radiography-systems market in India is experiencing growth due to the increasing healthcare expenditure by both the government and private sectors. As the Indian government allocates more funds to healthcare, the demand for advanced medical technologies, including mobile radiography systems, is likely to rise. In 2025, healthcare spending in India is projected to reach approximately $370 billion, reflecting a growth rate of around 12% annually. This increase in investment is expected to enhance the availability of mobile radiography systems in hospitals and clinics, thereby improving diagnostic capabilities and patient outcomes. Furthermore, the expansion of private healthcare facilities is anticipated to contribute to the market's growth, as these institutions often seek to adopt the latest technologies to attract patients and provide high-quality care.

Technological Innovations in Imaging

The mobile radiography-systems market is being propelled by continuous technological innovations in imaging techniques. Advancements such as digital radiography and wireless technology are enhancing the efficiency and accuracy of mobile imaging systems. In 2025, the market for digital radiography in India is projected to grow at a CAGR of approximately 15%, indicating a strong shift towards digital solutions. These innovations not only improve image quality but also reduce radiation exposure for patients, making mobile radiography systems more appealing to healthcare providers. As hospitals and clinics increasingly adopt these advanced technologies, the demand for mobile radiography systems is expected to rise, reflecting a broader trend towards modernization in the healthcare sector.

Increased Focus on Emergency Services

The mobile radiography-systems market is benefiting from an increased focus on emergency medical services in India. With the growing incidence of accidents and health emergencies, there is a pressing need for rapid diagnostic solutions that can be deployed in various settings, including ambulances and disaster response units. Mobile radiography systems provide immediate imaging capabilities, which are crucial for timely diagnosis and treatment in emergency situations. As the Indian government and private sector invest in enhancing emergency medical services, the demand for mobile radiography systems is likely to surge. This trend underscores the importance of having portable imaging solutions readily available in critical care scenarios, thereby improving patient outcomes and operational efficiency.

Expansion of Diagnostic Imaging Facilities

The mobile radiography-systems market is poised for growth due to the expansion of diagnostic imaging facilities across India. As healthcare infrastructure improves, more hospitals and clinics are incorporating advanced imaging technologies to meet the rising demand for diagnostic services. The establishment of new healthcare facilities, particularly in rural and semi-urban areas, is expected to drive the adoption of mobile radiography systems. By 2025, the number of diagnostic imaging centers in India is projected to increase by approximately 20%, creating a larger market for mobile solutions. This expansion not only enhances access to healthcare services but also encourages the integration of mobile radiography systems into routine diagnostic practices, thereby fostering market growth.