Expansion of Manufacturing Sector

The industrial lighting market in India is poised for growth due to the expansion of the manufacturing sector. With the government's focus on initiatives like 'Make in India', there is a substantial increase in manufacturing activities across various industries. This expansion necessitates improved lighting solutions to enhance productivity and safety in workplaces. The manufacturing sector's growth is projected to contribute approximately 25% to India's GDP by 2025, thereby driving the demand for advanced lighting systems. Consequently, the industrial lighting market is likely to benefit from this upward trend, as manufacturers seek to invest in high-quality lighting solutions to meet operational demands.

Government Initiatives and Policies

Government initiatives and policies aimed at promoting energy efficiency and sustainability are playing a pivotal role in shaping the industrial lighting market in India. Programs that encourage the adoption of energy-efficient technologies are likely to stimulate market growth. For instance, the Bureau of Energy Efficiency (BEE) has introduced various schemes to incentivize industries to upgrade their lighting systems. These initiatives not only aim to reduce energy consumption but also to lower greenhouse gas emissions. As a result, The industrial lighting market is expected to benefit from increased investments in energy-efficient lighting solutions. This aligns with national goals for sustainable development.

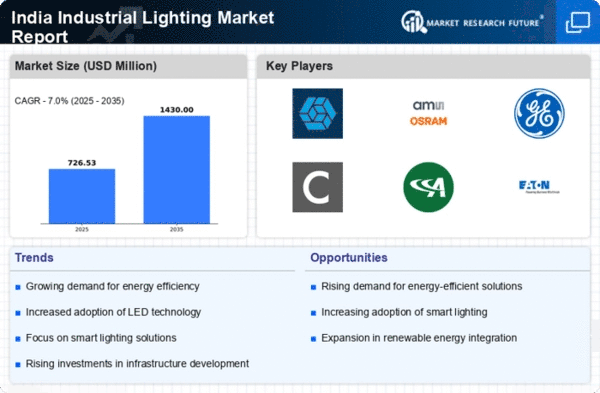

Growing Demand for Energy Efficiency

The industrial lighting market in India is experiencing a notable shift towards energy-efficient solutions. This trend is driven by increasing operational costs and the need for sustainable practices. Industries are seeking to reduce energy consumption, which has led to a surge in the adoption of energy-efficient lighting technologies. According to recent data, energy-efficient lighting can reduce energy usage by up to 50%. This demand for energy efficiency is further supported by government initiatives promoting sustainable industrial practices. As a result, The industrial lighting market is likely to see a significant increase in the adoption of energy-efficient solutions. This shift could enhance overall productivity and reduce operational costs.

Rising Awareness of Workplace Safety

The industrial lighting market in India is also being driven by a growing awareness of workplace safety. Adequate lighting is crucial for ensuring a safe working environment, particularly in manufacturing and industrial settings. Poor lighting can lead to accidents and decreased productivity, prompting companies to invest in better lighting solutions. Recent studies indicate that well-lit workplaces can improve employee productivity by up to 20%. As safety regulations become more stringent, industries are likely to prioritize investments in high-quality lighting systems, thereby propelling the growth of the industrial lighting market. This focus on safety is expected to shape purchasing decisions in the coming years.

Technological Advancements in Lighting Solutions

Technological advancements are significantly influencing the industrial lighting market in India. Innovations such as smart lighting systems and IoT-enabled solutions are becoming increasingly prevalent. These technologies offer enhanced control, energy savings, and improved safety features. For instance, smart lighting can adjust brightness based on occupancy, potentially reducing energy consumption by up to 30%. As industries strive for operational efficiency, the integration of these advanced technologies is expected to drive growth in the industrial lighting market. The ongoing research and development in lighting technologies suggest a promising future for the market, as companies seek to leverage these advancements for competitive advantage.