Increased Focus on Operational Agility

In the current business environment, operational agility has emerged as a key priority for organizations in India, significantly influencing the hybrid integration-platform market. Companies are striving to adapt quickly to changing market conditions and customer demands, necessitating flexible and scalable integration solutions. Hybrid integration platforms enable organizations to connect disparate systems and applications, thereby enhancing their ability to respond to market dynamics. Research indicates that businesses that prioritize operational agility can achieve a competitive edge, with studies showing that agile organizations are 50% more likely to outperform their peers. This growing emphasis on agility is likely to drive further adoption of hybrid integration solutions.

Rising Need for Enhanced Customer Experience

The hybrid integration-platform market is also being propelled by the rising need for enhanced customer experience among Indian businesses. Organizations are increasingly aware that delivering a seamless and personalized customer experience is crucial for retaining customers and driving loyalty. Hybrid integration platforms facilitate the integration of customer data from various sources, enabling businesses to gain comprehensive insights into customer behavior and preferences. This capability is essential for tailoring services and improving customer interactions. As companies invest more in customer experience initiatives, the demand for hybrid integration solutions is expected to rise, with projections indicating a potential market growth of 20% in the coming years.

Growing Demand for Real-Time Data Integration

The hybrid integration-platform market in India is experiencing a surge in demand for real-time data integration solutions. Organizations are increasingly recognizing the necessity of accessing and processing data in real-time to enhance decision-making and operational efficiency. This trend is particularly pronounced in sectors such as finance and retail, where timely data can significantly impact customer satisfaction and revenue generation. According to recent estimates, the market for real-time data integration solutions is projected to grow at a CAGR of approximately 25% over the next five years. This growth is indicative of the broader shift towards data-driven strategies, which is likely to propel the hybrid integration-platform market further as businesses seek to leverage integrated data for competitive advantage.

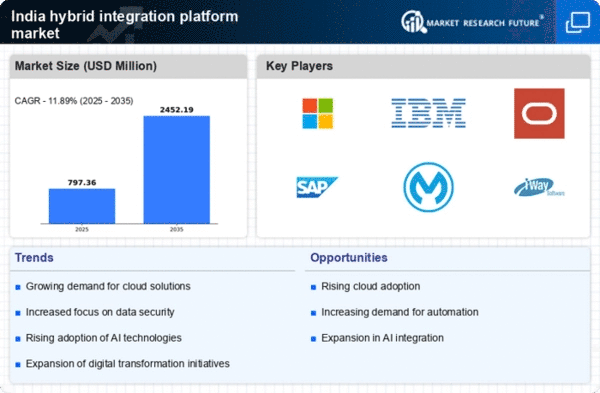

Expansion of Digital Transformation Initiatives

Digital transformation initiatives are becoming a cornerstone for businesses in India, driving the hybrid integration-platform market forward. Companies are increasingly adopting digital technologies to streamline operations, enhance customer experiences, and foster innovation. The integration of various digital tools and platforms is essential for achieving seamless workflows and maximizing the benefits of digital investments. As per industry reports, organizations that effectively implement hybrid integration strategies can expect to see productivity improvements of up to 30%. This trend underscores the critical role that hybrid integration platforms play in facilitating digital transformation, making them indispensable for businesses aiming to thrive in an increasingly digital landscape.

Adoption of Advanced Analytics and AI Technologies

The integration of advanced analytics and artificial intelligence (AI) technologies is significantly impacting the hybrid integration-platform market in India. Organizations are increasingly leveraging these technologies to derive actionable insights from their data, which necessitates robust integration capabilities. Hybrid integration platforms enable seamless data flow between various analytics tools and data sources, thereby enhancing the effectiveness of AI applications. As businesses recognize the value of data-driven decision-making, the demand for hybrid integration solutions that support advanced analytics is likely to grow. Current trends suggest that the market for AI-driven analytics is expected to expand at a CAGR of 30%, further underscoring the importance of hybrid integration platforms in this evolving landscape.