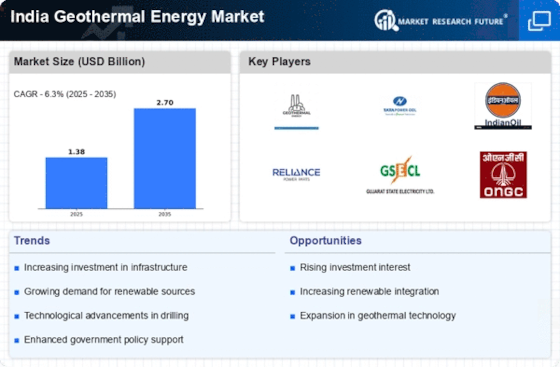

Market Share

India Geothermal Energy Market Share Analysis

In the dynamic landscape of India's Geothermal Energy market, companies employ various market share positioning strategies to gain a competitive edge and establish a strong presence. One prevalent approach involves differentiation through technological innovation. Companies invest in research and development to enhance the efficiency and reliability of geothermal power generation technologies, making their offerings stand out in the market. By staying at the forefront of technological advancements, these firms not only capture the attention of environmentally conscious consumers but also attract government support and partnerships.

Another key strategy involves strategic alliances and collaborations. Companies in the Indian geothermal energy sector often form partnerships with both domestic and international entities to leverage complementary strengths and resources. Collaborations can extend to joint ventures, where risks and rewards are shared, allowing firms to navigate challenges collectively. Such strategic alliances not only facilitate knowledge exchange but also enable companies to pool their financial and technical capabilities for large-scale projects, thereby increasing their market share.

Market penetration is yet another common strategy employed by companies in the India Geothermal Energy market. This approach focuses on capturing a larger share of the existing market by increasing sales to current customers or expanding the customer base. Companies may adopt aggressive pricing strategies, offer incentives, or invest in marketing campaigns to raise awareness about the benefits of geothermal energy. By targeting untapped segments and regions, firms aim to solidify their position and enhance their market share through increased adoption of geothermal solutions.

In addition to the above, a sustainable and environmentally conscious image plays a crucial role in market share positioning. As the demand for clean energy sources rises, companies in the geothermal sector strive to position themselves as leaders in sustainability. This involves not only adopting eco-friendly practices in their operations but also actively participating in community initiatives and environmental conservation efforts. A positive public perception not only attracts consumers but also influences government policies and regulations, creating a conducive environment for market growth.

Government relations and policy advocacy constitute another vital aspect of market share positioning in the Indian geothermal energy sector. Companies actively engage with policymakers to shape regulations that favor the growth of the geothermal industry. By advocating for supportive policies, such as incentives, subsidies, and a conducive regulatory framework, companies aim to create an environment conducive to investment and expansion. Strong government relations not only facilitate a smoother business environment but also contribute to the overall growth and acceptance of geothermal energy in the country.

The market share positioning strategies in India's Geothermal Energy market are diverse and dynamic. Companies employ a combination of technological innovation, strategic alliances, market penetration, sustainable practices, and government relations to carve out a competitive space. As the nation continues to focus on sustainable energy solutions, the effectiveness of these strategies will play a pivotal role in determining the market leaders and shaping the future trajectory of the geothermal energy sector in India.

Leave a Comment