Regulatory Compliance and Reporting

The regulatory landscape in the India generative ai bfsi market is becoming increasingly complex, necessitating advanced solutions for compliance and reporting. Generative AI can assist financial institutions in navigating these challenges by automating compliance processes and ensuring adherence to regulatory requirements. This technology enables real-time monitoring of transactions and reporting, thereby reducing the risk of non-compliance penalties. As regulatory bodies continue to emphasize transparency and accountability, the adoption of generative AI for compliance purposes is likely to grow. Financial institutions that effectively leverage these technologies may find themselves better equipped to meet regulatory demands in the evolving India generative ai bfsi market.

Increased Demand for Personalization

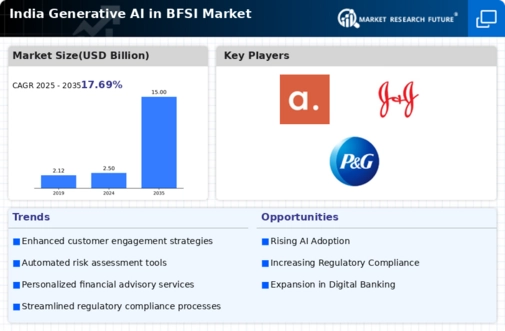

The India generative ai bfsi market is witnessing a surge in demand for personalized financial services. Customers increasingly expect tailored solutions that cater to their unique financial needs. Generative AI technologies enable financial institutions to analyze vast amounts of customer data, allowing for the creation of personalized investment strategies, loan offerings, and insurance products. According to recent estimates, the market for personalized financial services in India is projected to grow at a compound annual growth rate of 25% over the next five years. This trend indicates that financial institutions leveraging generative AI can enhance customer satisfaction and loyalty, thereby gaining a competitive edge in the India generative ai bfsi market.

Enhanced Fraud Detection Capabilities

The India generative ai bfsi market is experiencing advancements in fraud detection capabilities, driven by the integration of generative AI technologies. Financial institutions are utilizing AI algorithms to analyze transaction patterns and identify anomalies that may indicate fraudulent activities. This proactive approach to fraud detection not only protects customers but also safeguards the financial institution's reputation. With the increasing sophistication of cyber threats, the demand for robust fraud detection systems is paramount. It is estimated that the implementation of generative AI in fraud detection could reduce fraud losses by up to 40% in the coming years, underscoring its critical role in the India generative ai bfsi market.

Investment in AI Research and Development

Investment in research and development within the India generative ai bfsi market is on the rise, as financial institutions recognize the potential of generative AI to transform their operations. Companies are allocating significant resources to develop innovative AI solutions that enhance customer experience, improve risk management, and streamline operations. The Indian government has also shown support for AI initiatives, with various policies aimed at fostering innovation in the technology sector. This collaborative environment is likely to accelerate the development of generative AI applications in the BFSI sector. As a result, organizations that prioritize R&D in generative AI may gain a substantial advantage in the competitive landscape of the India generative ai bfsi market.

Operational Efficiency through Automation

In the India generative ai bfsi market, operational efficiency is being significantly enhanced through automation powered by generative AI. Financial institutions are increasingly adopting AI-driven solutions to automate routine tasks such as data entry, compliance checks, and customer service interactions. This shift not only reduces operational costs but also minimizes human error, leading to improved service delivery. Reports suggest that automation in the BFSI sector could lead to cost savings of up to 30% by 2026. As a result, organizations that embrace generative AI technologies are likely to streamline their operations, thereby positioning themselves favorably within the competitive landscape of the India generative ai bfsi market.