Advancements in AI Technology

Technological advancements in artificial intelligence are significantly influencing the generative ai-in-bfsi market. Innovations in machine learning algorithms and natural language processing are enabling financial institutions to leverage AI for various applications, including predictive analytics and personalized financial advice. The market for AI in the BFSI sector is projected to reach $22 billion by 2025, reflecting a compound annual growth rate (CAGR) of 23%. These advancements not only enhance the capabilities of financial services but also foster a competitive landscape where institutions must adopt AI to remain relevant.

Evolving Customer Expectations

the generative AI in BFSI market is being shaped by evolving customer expectations. Today's consumers demand personalized and seamless experiences across all financial services. Generative AI technologies enable institutions to analyze vast amounts of data to tailor services to individual preferences. As a result, financial organizations are increasingly adopting AI solutions to meet these expectations. A recent survey indicated that 70% of customers are more likely to engage with institutions that offer personalized services, highlighting the importance of AI in enhancing customer engagement and loyalty.

Increased Focus on Data Security

Data security remains a critical concern for the generative ai-in-bfsi market. With the rise of cyber threats, financial institutions are prioritizing the implementation of AI-driven security measures to protect sensitive customer information. The integration of generative AI can enhance threat detection and response times, potentially reducing the risk of data breaches. Reports indicate that organizations investing in AI-based security solutions can decrease the likelihood of breaches by up to 40%. This focus on security is essential for maintaining customer trust and regulatory compliance in the BFSI sector.

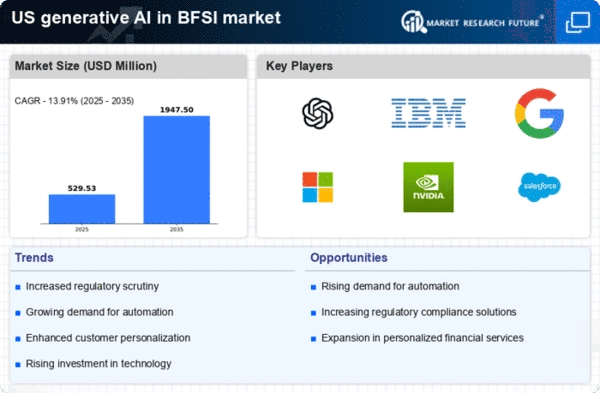

Rising Demand for Automated Solutions

The generative ai-in-bfsi market is experiencing a notable surge in demand for automated solutions. Financial institutions are increasingly seeking to enhance operational efficiency and reduce costs through automation. This trend is driven by the need to streamline processes such as customer service, fraud detection, and risk assessment. According to recent data, the automation of these processes can lead to cost reductions of up to 30%. As a result, the adoption of generative AI technologies is becoming a strategic priority for many organizations in the BFSI sector, aiming to improve service delivery and customer satisfaction.

Regulatory Pressures and Compliance Needs

Regulatory pressures are a significant driver for the generative ai-in-bfsi market. Financial institutions face stringent compliance requirements that necessitate the use of advanced technologies to ensure adherence to regulations. Generative AI can assist in automating compliance processes, thereby reducing the risk of non-compliance and associated penalties. The market is witnessing a shift towards AI solutions that can provide real-time monitoring and reporting capabilities. As regulatory frameworks continue to evolve, the demand for AI-driven compliance tools is expected to grow, positioning generative AI as a vital component in the BFSI sector.