Increasing Consumer Awareness

The food antioxidants market in India is experiencing growth due to rising consumer awareness regarding health and nutrition. As individuals become more informed about the benefits of antioxidants in preventing oxidative stress and chronic diseases, demand for antioxidant-rich food products is likely to increase. This trend is reflected in the growing popularity of health supplements and functional foods that contain natural antioxidants. According to recent data, the market for health supplements in India is projected to reach approximately $8 billion by 2025, indicating a robust interest in health-oriented products. Consequently, manufacturers are focusing on incorporating natural antioxidants into their offerings to cater to this informed consumer base, thereby driving the food antioxidants market.

Shift Towards Clean Label Products

The food antioxidants market in India is witnessing a notable shift towards clean label products, driven by consumer demand for transparency in food ingredients. As consumers increasingly seek products with minimal processing and recognizable ingredients, manufacturers are compelled to reformulate their offerings. This trend is evident in the rise of organic and natural food products, which often contain higher levels of antioxidants. Market Research Future indicates that the organic food sector in India is expected to grow at a CAGR of 25% over the next five years. This shift towards clean labels not only enhances the appeal of food products but also supports the growth of the food antioxidants market.

Rising Incidence of Lifestyle Diseases

The food antioxidants market in India is significantly impacted by the rising incidence of lifestyle diseases such as diabetes, heart disease, and obesity. As these health issues become more prevalent, consumers are increasingly seeking dietary solutions that can mitigate health risks. Antioxidants are recognized for their potential role in combating oxidative stress, which is linked to various chronic conditions. This growing awareness is driving demand for food products fortified with antioxidants. The market for functional foods, which often include antioxidant-rich ingredients, is projected to grow substantially, potentially reaching $10 billion by 2026. This trend underscores the importance of antioxidants in promoting health and wellness, thereby bolstering the food antioxidants market.

Regulatory Support for Natural Additives

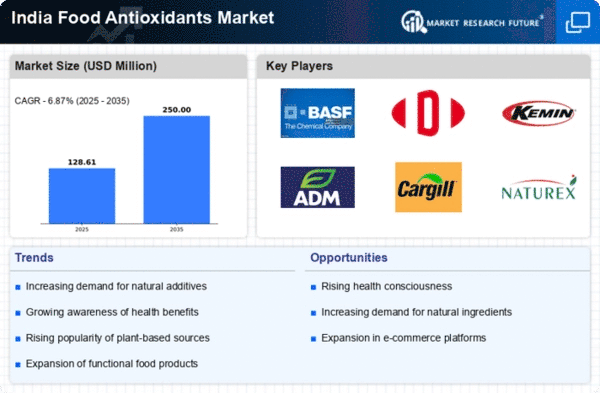

The food antioxidants market in India is positively influenced by regulatory support for the use of natural additives in food products. The Food Safety and Standards Authority of India (FSSAI) has established guidelines that promote the use of natural antioxidants over synthetic alternatives. This regulatory framework encourages food manufacturers to adopt healthier formulations, which aligns with consumer preferences for clean label products. As a result, the market for natural antioxidants is expected to expand, with an anticipated growth rate of around 7% annually. This regulatory backing not only enhances product safety but also boosts consumer confidence, further propelling the food antioxidants market.

Innovation in Food Processing Technologies

The food antioxidants market in India is benefiting from advancements in food processing technologies that enhance the stability and efficacy of antioxidants. Innovations such as microencapsulation and advanced extraction methods allow for better preservation of antioxidant properties during food production. These technologies enable manufacturers to create products with longer shelf lives while maintaining nutritional value. As a result, the market is likely to see an influx of new products that leverage these innovations. The food processing industry in India is projected to grow at a CAGR of 8% over the next five years, indicating a favorable environment for the development of antioxidant-rich food products. This technological progress is expected to play a crucial role in shaping the future of the food antioxidants market.