Government Initiatives and Support

Government initiatives aimed at promoting digital transformation significantly impact the enterprise mobile-application-development-platform market. Programs such as Digital India encourage businesses to adopt mobile technologies, thereby creating a conducive environment for platform development. The government's focus on enhancing digital infrastructure and providing financial incentives for technology adoption is likely to stimulate market growth. With an increasing number of startups and SMEs entering the mobile application space, the enterprise mobile-application-development-platform market is expected to benefit from these supportive measures. This trend indicates a strong alignment between government policies and market dynamics, fostering innovation and competitiveness.

Rising Demand for Mobile Solutions

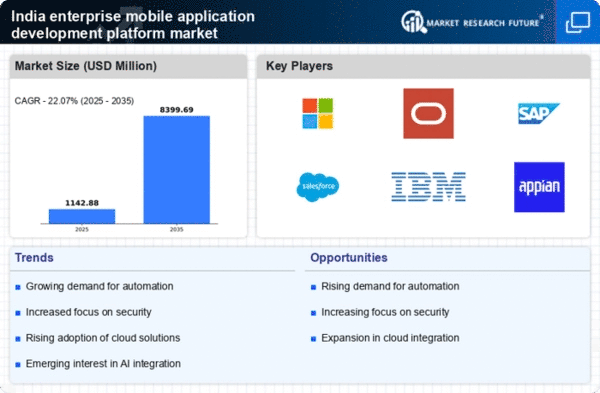

The enterprise mobile-application-development-platform market in India experiences a notable surge in demand for mobile solutions. As businesses increasingly recognize the necessity of mobile applications for operational efficiency and customer engagement, the market is projected to grow at a CAGR of approximately 25% over the next five years. This growth is driven by the need for real-time data access and improved communication channels. Enterprises are investing in mobile applications to enhance productivity and streamline processes, which in turn fuels the demand for robust development platforms. The shift towards mobile-first strategies among organizations further emphasizes the importance of these platforms in meeting evolving business needs.

Growing Emphasis on User Experience

In the enterprise mobile-application-development-platform market, there is a growing emphasis on user experience (UX) design. Companies are increasingly aware that a seamless and intuitive user interface can significantly enhance user engagement and satisfaction. As a result, development platforms are evolving to incorporate advanced UX design tools and features. This trend is particularly relevant in India, where a diverse user base demands applications that cater to varying preferences and needs. The focus on UX is likely to drive investments in development platforms that prioritize user-centric design, thereby influencing the overall market landscape.

Shift Towards Cloud-Based Solutions

The shift towards cloud-based solutions is a significant driver in the enterprise mobile-application-development-platform market. As organizations seek to reduce infrastructure costs and enhance scalability, cloud-based platforms are becoming increasingly attractive. This trend is particularly pronounced in India, where businesses are adopting cloud technologies to facilitate remote work and improve collaboration. The flexibility and accessibility offered by cloud solutions are likely to drive further adoption of mobile application development platforms. As more enterprises migrate to the cloud, the demand for integrated development environments that support cloud functionalities will likely increase, shaping the future of the market.

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) into the enterprise mobile-application-development-platform market is transforming how applications are developed and utilized. AI capabilities enable developers to create smarter applications that can learn from user interactions and provide personalized experiences. This trend is particularly relevant in India, where businesses are increasingly leveraging AI to enhance operational efficiency and decision-making processes. The potential for AI to automate routine tasks and improve application performance suggests that platforms incorporating these technologies will gain a competitive edge. As AI continues to evolve, its impact on the enterprise mobile-application-development-platform market is expected to grow.