Rise of Remote Work Culture

The rise of remote work culture in India has emerged as a crucial driver for the enterprise key-management market. As organizations adapt to flexible work arrangements, the need for secure access to sensitive data from various locations has intensified. This shift necessitates robust key management solutions to ensure that data remains protected, regardless of where employees are working. Companies are increasingly adopting enterprise key-management systems to manage encryption keys effectively and maintain data integrity. The market is projected to expand, with a potential growth rate of 15% as businesses seek to enhance their security posture in a remote work environment.

Growing Demand for Data Privacy

In the context of the enterprise key-management market, the growing demand for data privacy is a significant driver. With increasing awareness among consumers regarding data protection, organizations are compelled to implement stringent security measures. This trend is particularly pronounced in sectors such as finance and healthcare, where sensitive information is handled. The enterprise key-management market is expected to witness a substantial increase in adoption rates, as companies seek to safeguard customer data and build trust. The market's value is anticipated to reach $500 million by 2026, reflecting the urgency for effective key management solutions.

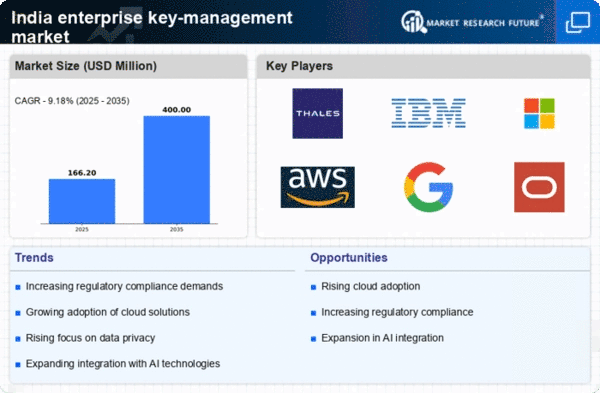

Increasing Regulatory Compliance

The enterprise key-management market in India is experiencing a surge due to the increasing regulatory compliance requirements imposed by government bodies. Organizations are mandated to adhere to various data protection laws, such as the Information Technology Act and the Personal Data Protection Bill. These regulations necessitate robust key management solutions to ensure data security and privacy. As a result, businesses are investing in enterprise key-management systems to avoid penalties and maintain compliance. The market is projected to grow at a CAGR of approximately 20% over the next five years, driven by the need for secure data handling and management practices.

Advancements in Cryptographic Technologies

Advancements in cryptographic technologies are significantly influencing the enterprise key-management market in India. Innovations in encryption algorithms and key management protocols are enabling organizations to enhance their data security measures. As cyber threats evolve, businesses are compelled to adopt more sophisticated key management solutions to protect sensitive information. The enterprise key-management market is likely to benefit from these technological advancements, with a projected growth rate of 18% over the next few years. Organizations are increasingly recognizing the importance of integrating cutting-edge cryptographic technologies into their security frameworks to mitigate risks.

Expansion of Digital Transformation Initiatives

The enterprise key-management market is being propelled by the expansion of digital transformation initiatives across various industries in India. As organizations transition to digital platforms, the need for secure data management becomes paramount. This shift is leading to an increased reliance on encryption and key management solutions to protect sensitive information. Companies are investing in enterprise key-management systems to facilitate secure digital transactions and communications. The market is likely to grow significantly, with estimates suggesting a potential increase of 25% in adoption rates over the next few years, as businesses prioritize security in their digital strategies.