Growing Cyber Threat Landscape

The endpoint security market in India is experiencing a surge due to the escalating cyber threat landscape. With cyberattacks becoming increasingly sophisticated, organizations are compelled to invest in robust endpoint security solutions. Reports indicate that the number of cyber incidents in India has risen by over 30% in the past year, prompting businesses to prioritize their cybersecurity strategies. This trend is particularly pronounced among small and medium enterprises (SMEs), which often lack the resources to implement comprehensive security measures. As a result, the demand for endpoint security solutions is expected to grow significantly, with projections suggesting a market expansion of approximately 25% annually. The endpoint security market is thus positioned to play a crucial role in safeguarding sensitive data and maintaining operational integrity.

Rising Awareness of Data Privacy

The endpoint security market in India is significantly influenced by the rising awareness of data privacy among consumers and businesses alike. With the implementation of stringent data protection regulations, organizations are increasingly recognizing the need to secure their endpoints to comply with legal requirements. The endpoint security market is thus experiencing a shift towards solutions that not only protect against cyber threats but also ensure data privacy. Recent surveys indicate that over 60% of Indian consumers are concerned about their personal data security, prompting businesses to adopt comprehensive endpoint security measures. This growing emphasis on data privacy is likely to drive market growth, with estimates suggesting an increase of around 15% in endpoint security investments over the next few years.

Digital Transformation Initiatives

India's rapid digital transformation is a key driver for the endpoint security market. As organizations increasingly adopt cloud services, mobile devices, and IoT technologies, the attack surface expands, necessitating advanced security measures. The endpoint security market is witnessing heightened demand for solutions that can protect diverse endpoints, including laptops, smartphones, and connected devices. According to recent studies, nearly 70% of Indian businesses have accelerated their digital initiatives, leading to a corresponding increase in cybersecurity investments. This shift not only enhances operational efficiency but also raises awareness about the importance of endpoint security. Consequently, the market is projected to grow by 20% over the next few years, as companies seek to mitigate risks associated with digital transformation.

Shift Towards Managed Security Services

The endpoint security market in India is increasingly characterized by a shift towards managed security services (MSS). Organizations are recognizing the benefits of outsourcing their security needs to specialized providers, allowing them to focus on core business activities. The endpoint security market is thus witnessing a rise in demand for MSS offerings, which provide comprehensive protection against cyber threats. Recent reports suggest that the managed security services market in India is expected to grow by 22% annually, driven by the need for 24/7 monitoring and incident response capabilities. This trend is particularly relevant for small and medium enterprises that may lack the expertise to manage endpoint security in-house. As a result, the endpoint security market is likely to expand as more organizations opt for managed services to enhance their security posture.

Increased Investment in IT Infrastructure

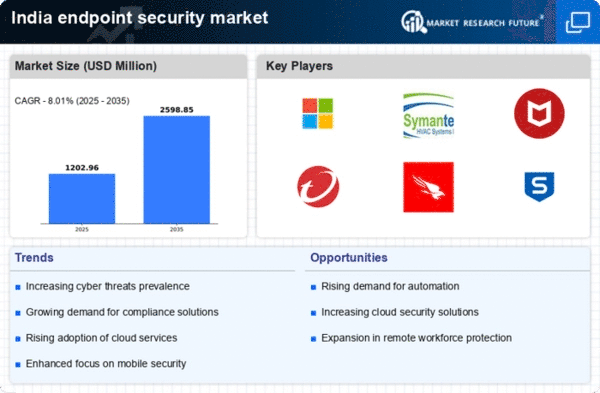

The endpoint security market in India is benefiting from increased investment in IT infrastructure across various sectors. As organizations modernize their IT environments, the need for effective endpoint security solutions becomes paramount. The endpoint security market is witnessing a surge in demand for advanced security technologies, including endpoint detection and response (EDR) and threat intelligence solutions. Recent data indicates that IT spending in India is projected to reach $100 billion by 2025, with a significant portion allocated to cybersecurity initiatives. This trend reflects a growing recognition of the importance of safeguarding endpoints against evolving threats. Consequently, the market is expected to grow at a compound annual growth rate (CAGR) of approximately 18% as organizations prioritize endpoint security in their IT strategies.