Increasing Data Breaches

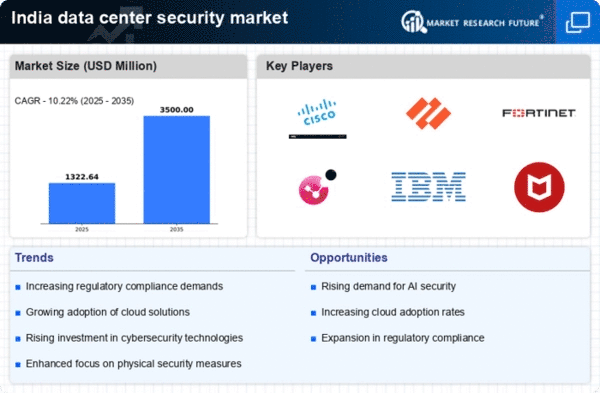

The data center-security market in India is experiencing heightened demand due to the alarming rise in data breaches. Reports indicate that the number of data breaches in India has surged by over 30% in the past year, prompting organizations to invest heavily in security measures. This trend is driven by the increasing sophistication of cybercriminals and the growing value of data. As businesses recognize the potential financial and reputational damage caused by breaches, they are prioritizing investments in advanced security solutions. The data center-security market is thus positioned for growth, as companies seek to protect sensitive information and maintain customer trust. The urgency to safeguard data assets is likely to drive innovation and adoption of cutting-edge technologies within the market.

Cloud Adoption and Security

The rapid adoption of cloud computing in India is significantly influencing the data center-security market. As organizations migrate to cloud environments, they face new security challenges that necessitate robust protective measures. According to recent studies, approximately 70% of Indian enterprises are expected to adopt cloud services by 2026, which underscores the need for enhanced security protocols. This shift is prompting businesses to invest in comprehensive security solutions that can protect data across hybrid and multi-cloud environments. The data center-security market is thus evolving to address these challenges, with a focus on integrating security into cloud architectures. This trend not only enhances data protection but also ensures compliance with regulatory requirements, further driving market growth.

Regulatory Landscape Evolution

The evolving regulatory landscape in India is a critical driver for the data center-security market. With the introduction of stringent data protection laws, organizations are compelled to enhance their security frameworks to comply with legal requirements. The Personal Data Protection Bill, which is anticipated to be enacted soon, mandates that companies implement robust security measures to protect personal data. This regulatory pressure is likely to increase investments in security technologies, as non-compliance can result in hefty fines and legal repercussions. The data center-security market is thus positioned to benefit from this trend, as businesses seek to align their security practices with regulatory expectations. The emphasis on compliance is expected to drive demand for advanced security solutions and services.

Rising Awareness of Data Privacy

There is a growing awareness of data privacy among consumers and businesses in India, which is significantly impacting the data center-security market. As individuals become more informed about their rights regarding personal data, they are demanding greater transparency and security from organizations. This shift in consumer expectations is prompting businesses to prioritize data protection measures. Surveys indicate that over 60% of Indian consumers are concerned about how their data is handled, leading companies to invest in security solutions that ensure data privacy. The data center-security market is thus witnessing increased demand for technologies that enhance data protection and privacy compliance. This trend is likely to shape the future of security practices within organizations, as they strive to meet consumer expectations.

Technological Advancements in Security Solutions

Technological advancements are playing a pivotal role in shaping the data center-security market in India. Innovations such as artificial intelligence, machine learning, and blockchain are being integrated into security solutions, enhancing their effectiveness against evolving threats. The market is witnessing a shift towards automated security systems that can detect and respond to threats in real-time. As organizations seek to bolster their security postures, investments in these advanced technologies are expected to rise. Reports suggest that the market for AI-driven security solutions is projected to grow by over 25% annually in the coming years. The data center-security market is thus adapting to these technological changes, which are likely to redefine security strategies and improve overall resilience against cyber threats.