Regulatory Clarity and Compliance

The evolving regulatory landscape in India is a significant driver for the crypto atm market. As the government establishes clearer guidelines for cryptocurrency operations, businesses are more likely to invest in crypto ATMs. Recent developments suggest that regulatory bodies are working towards creating a framework that supports innovation while ensuring consumer protection. This clarity may encourage more entrepreneurs to enter the crypto atm market, leading to increased competition and improved services. As compliance becomes more straightforward, the market could witness a surge in ATM installations, catering to a growing user base eager to engage with cryptocurrencies.

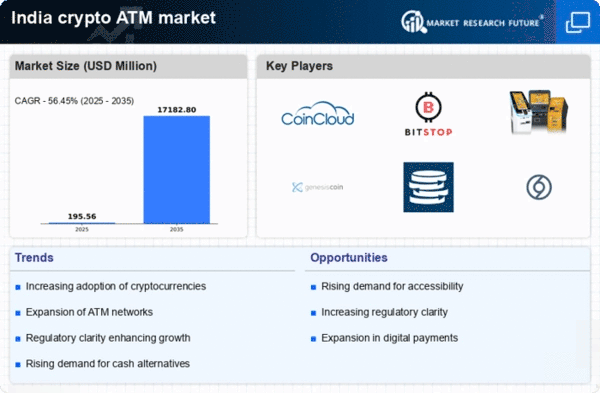

Growing Adoption of Cryptocurrencies

The increasing acceptance of cryptocurrencies among the Indian populace is a pivotal driver for the crypto atm market. As more individuals and businesses recognize the utility of digital currencies, the demand for accessible means to transact in these assets rises. Reports indicate that approximately 15% of the Indian population has engaged with cryptocurrencies, highlighting a burgeoning interest. This trend is likely to propel the establishment of more crypto ATMs across urban and semi-urban areas, facilitating easier access for users. The crypto atm market is thus positioned to benefit from this growing adoption, as it aligns with the needs of a tech-savvy demographic eager to engage in digital finance.

Financial Inclusion and Accessibility

The crypto atm market is poised to benefit from the drive towards financial inclusion in India. With a substantial portion of the population still unbanked, crypto ATMs present an alternative means of accessing financial services. These machines can facilitate transactions for individuals who may not have access to traditional banking infrastructure. The potential for crypto ATMs to serve as a bridge to financial services is significant, particularly in rural areas where banking facilities are limited. The crypto atm market is likely to expand as it addresses these gaps, providing essential services to underserved populations and promoting broader financial participation.

Investment Opportunities in Digital Assets

The crypto atm market is significantly influenced by the increasing interest in digital asset investments. With the potential for high returns, many Indian investors are diversifying their portfolios to include cryptocurrencies. Data suggests that investment in cryptocurrencies has surged by over 200% in the last year alone, indicating a robust appetite for these assets. This trend is likely to drive the demand for crypto ATMs, as investors seek convenient ways to buy and sell their digital currencies. The crypto atm market stands to gain from this investment boom, as more ATMs are deployed to cater to the needs of both novice and seasoned investors.

Technological Integration and User Experience

The integration of advanced technology into the crypto atm market is enhancing user experience and driving growth. Innovations such as biometric authentication and user-friendly interfaces are making transactions more secure and accessible. As technology evolves, the crypto atm market is likely to see a rise in installations that prioritize customer experience. Enhanced security features may alleviate concerns regarding fraud, thereby attracting a broader user base. Furthermore, the seamless integration of mobile wallets with ATMs could streamline transactions, making it easier for users to engage with cryptocurrencies. This technological advancement is crucial for the market's expansion in India.