Rising Industrial Automation

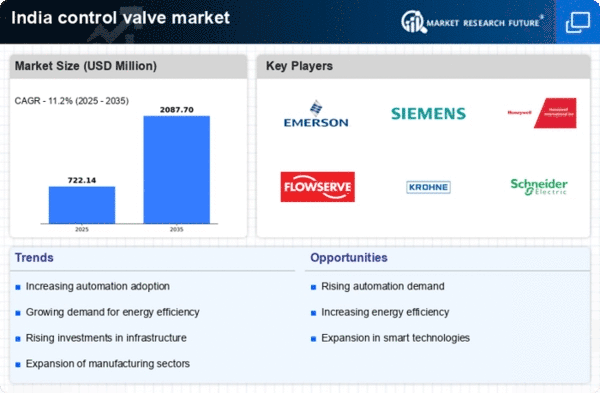

The control valve market in India is experiencing a notable surge due to the increasing adoption of industrial automation across various sectors. Industries such as oil and gas, water treatment, and power generation are integrating automated systems to enhance operational efficiency. This trend is expected to drive the demand for control valves, which are essential components in automated processes. According to recent estimates, the automation market in India is projected to grow at a CAGR of approximately 10% over the next five years. As industries seek to optimize their processes, the control valve market is likely to benefit significantly from this shift towards automation, reinforcing its position within the control valve market.

Emergence of Smart Technologies

The integration of smart technologies in the control valve market is transforming traditional practices. With the advent of IoT and advanced data analytics, control valves are becoming more intelligent, allowing for real-time monitoring and predictive maintenance. This shift is particularly relevant in sectors such as manufacturing and energy, where operational efficiency is paramount. The smart control valve segment is anticipated to witness a growth rate of around 15% annually in India. As industries increasingly adopt these technologies, the control valve market is likely to evolve, offering innovative solutions that enhance performance and reliability.

Growth in Infrastructure Development

India's ongoing infrastructure development initiatives are significantly impacting the control valve market. The government's focus on enhancing transportation, energy, and water supply systems is leading to increased investments in infrastructure projects. For instance, the National Infrastructure Pipeline aims to invest over $1.4 trillion in various sectors by 2025. This investment is likely to create substantial demand for control valves, which are critical for managing fluid flow in construction and utility projects. As infrastructure development accelerates, the control valve market is poised to experience robust growth, driven by the need for reliable and efficient flow control solutions.

Increased Focus on Energy Efficiency

The control valve market in India is being driven by a heightened emphasis on energy efficiency across various sectors. Industries are increasingly recognizing the importance of optimizing energy consumption to reduce operational costs and environmental impact. Control valves play a crucial role in regulating flow and pressure, thereby contributing to energy savings. Government initiatives promoting energy-efficient practices further bolster this trend. Reports indicate that energy-efficient technologies can reduce energy consumption by up to 30%. As organizations strive to meet sustainability goals, the control valve market is expected to thrive, fueled by the demand for energy-efficient solutions.

Expansion of the Chemical Processing Sector

The chemical processing sector in India is undergoing rapid expansion, which is positively influencing the control valve market. With the increasing production of chemicals, pharmaceuticals, and petrochemicals, there is a growing need for reliable flow control solutions. Control valves are essential for maintaining process stability and safety in chemical plants. The Indian chemical industry is projected to reach $300 billion by 2025, indicating a robust growth trajectory. This expansion is likely to create substantial opportunities for the control valve market, as manufacturers seek advanced solutions to meet the demands of a growing sector.