Rising Demand for Seamless Connectivity

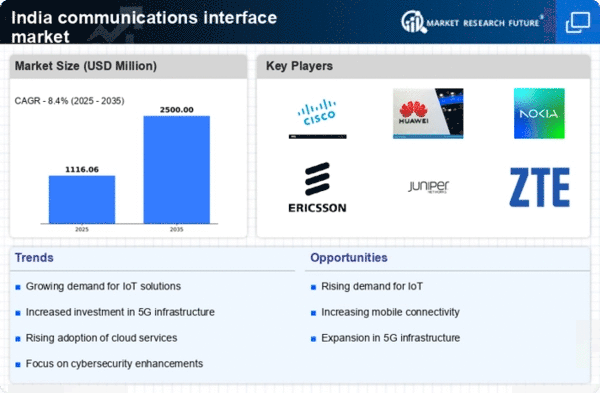

The communications interface market in India is experiencing a notable surge in demand for seamless connectivity solutions. As businesses and consumers increasingly rely on digital communication, the need for efficient and reliable interfaces has become paramount. This trend is driven by the proliferation of mobile devices and the growing adoption of cloud-based services. According to recent data, the market is projected to grow at a CAGR of approximately 15% over the next five years. This growth is indicative of the increasing reliance on digital communication tools, which necessitate advanced communications interfaces. Furthermore, the rise of remote work and digital collaboration tools has further amplified this demand, compelling companies to invest in robust communications infrastructure. Consequently, the communications interface market is poised for significant expansion as organizations seek to enhance their connectivity capabilities.

Emergence of Smart Devices and Applications

The emergence of smart devices and applications is significantly impacting the communications interface market in India. With the proliferation of smartphones, tablets, and IoT devices, there is an increasing need for interfaces that can seamlessly connect and communicate with these technologies. This trend is fostering innovation in the development of user-friendly communication interfaces that cater to diverse applications, from smart homes to industrial automation. Recent statistics indicate that the smart device market in India is projected to grow by over 25% in the next few years, which will likely drive demand for compatible communications interfaces. As consumers and businesses alike seek to leverage the capabilities of smart technologies, the communications interface market is expected to evolve rapidly, adapting to the changing landscape of digital communication.

Advancements in Telecommunications Technology

Technological advancements in telecommunications are significantly influencing the communications interface market in India. The rollout of 5G technology is expected to revolutionize communication by providing faster data speeds and lower latency. This transition is likely to enhance the performance of various communication interfaces, making them more efficient and user-friendly. As per industry estimates, the 5G rollout could lead to a market growth of around 20% in the next few years. Additionally, innovations in fiber optics and satellite communications are also contributing to the evolution of the communications interface market. These advancements not only improve connectivity but also expand the reach of communication services to rural and underserved areas. As a result, the market is witnessing a shift towards more sophisticated and versatile communication solutions that cater to diverse user needs.

Increased Investment in Digital Infrastructure

The communications interface market in India is benefiting from increased investment in digital infrastructure. The government and private sector are channeling substantial resources into enhancing connectivity across urban and rural areas. This investment is aimed at bridging the digital divide and ensuring that all citizens have access to reliable communication services. Recent reports indicate that the Indian government plans to invest over $1 billion in digital infrastructure projects in the coming years. This influx of capital is likely to stimulate growth in the communications interface market, as it encourages the development of new technologies and solutions. Furthermore, the emphasis on smart cities and digital transformation initiatives is driving demand for advanced communications interfaces that can support a wide range of applications. Consequently, this trend is expected to propel the market forward, fostering innovation and improving overall communication capabilities.

Growing Adoption of Unified Communication Solutions

The growing adoption of unified communication solutions is reshaping the communications interface market in India. Organizations are increasingly recognizing the benefits of integrating various communication tools into a single platform, which enhances collaboration and productivity. This trend is particularly evident in the corporate sector, where businesses are investing in unified communication systems to streamline operations. Market analysis suggests that the unified communication segment could account for approximately 30% of the overall communications interface market by 2026. This shift is driven by the need for efficient communication channels that facilitate real-time collaboration among teams, especially in a hybrid work environment. As companies continue to prioritize employee engagement and operational efficiency, the demand for unified communication solutions is expected to rise, further propelling the growth of the communications interface market.