Growing Emphasis on Data Security

In the cloud business-email market, the emphasis on data security is intensifying. With increasing cyber threats and data breaches, organizations are prioritizing secure email solutions to protect sensitive information. The Indian government has implemented stringent regulations regarding data protection, compelling businesses to adopt compliant email services. As a result, the market is witnessing a shift towards providers that offer robust security features, including end-to-end encryption and multi-factor authentication. According to recent data, approximately 70% of Indian businesses consider security a critical factor when selecting cloud email services. This growing concern for data integrity and privacy is likely to drive investments in secure cloud business-email solutions, fostering a competitive landscape among service providers.

Increased Focus on Customer Experience

In the cloud business-email market, there is a growing focus on enhancing customer experience. Businesses are increasingly aware that effective communication is vital for customer satisfaction and retention. As a result, email service providers are prioritizing user-friendly interfaces, responsive customer support, and customizable features. Recent surveys indicate that over 60% of Indian businesses consider customer experience a key factor in their choice of email service. This trend is driving providers to invest in improving their offerings, ensuring that they meet the diverse needs of their clients. By focusing on customer-centric solutions, companies in the cloud business-email market can foster loyalty and gain a competitive edge in an increasingly crowded marketplace.

Rising Demand for Remote Work Solutions

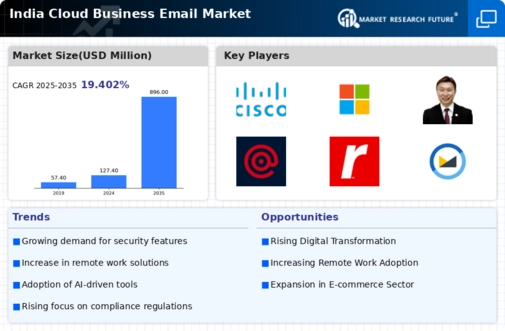

The cloud business-email market in India experiences a notable surge in demand for remote work solutions. As organizations increasingly adopt flexible work arrangements, the need for reliable and efficient email services becomes paramount. This shift is reflected in the market's growth, with estimates suggesting a CAGR of approximately 15% over the next five years. Companies are seeking cloud-based email solutions that facilitate seamless communication and collaboration among remote teams. The ability to access emails from any location enhances productivity and operational efficiency. Furthermore, the integration of advanced features such as video conferencing and file sharing within email platforms is becoming a key differentiator. This trend indicates a significant opportunity for providers in the cloud business-email market to innovate and cater to the evolving needs of businesses in India.

Technological Advancements in Email Services

Technological advancements are reshaping the cloud business-email market in India. Innovations such as artificial intelligence (AI) and machine learning (ML) are being integrated into email platforms, enhancing user experience and productivity. Features like smart sorting, automated responses, and predictive text are becoming standard, allowing users to manage their emails more efficiently. The adoption of these technologies is expected to increase, with market analysts projecting a growth rate of around 12% in the next few years. As businesses seek to optimize their communication processes, the demand for advanced email solutions is likely to rise. This trend presents an opportunity for cloud business-email providers to differentiate themselves through innovative features and improved functionality.

Expansion of Small and Medium Enterprises (SMEs)

The cloud business-email market is significantly influenced by the expansion of small and medium enterprises (SMEs) in India. As SMEs increasingly recognize the importance of digital communication, the demand for cloud-based email solutions is on the rise. These businesses often seek cost-effective and scalable email services that can grow with their operations. Recent statistics indicate that SMEs contribute to over 30% of India's GDP, highlighting their economic significance. The cloud business-email market is poised to benefit from this growth, as SMEs look for solutions that enhance their professional image and streamline communication. Providers that tailor their offerings to meet the unique needs of SMEs may find substantial opportunities for growth in this segment.