India Automotive Industry Size

Market Size Snapshot

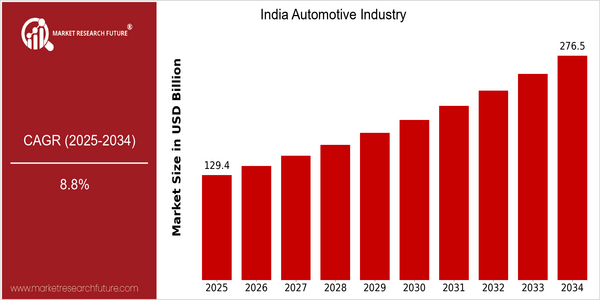

| Year | Value |

|---|---|

| 2025 | USD 129.39 Billion |

| 2034 | USD 276.46 Billion |

| CAGR (2025-2034) | 8.8 % |

Note – Market size depicts the revenue generated over the financial year

The Indian automobile industry is expected to grow at a rate of 27.6 per cent per annum to reach $276 billion by 2034. This translates into a CAGR of 8.8 per cent. The industry’s resilience and the ability to cope with changing customer preferences and technological developments are evident from this dynamic growth. Rising demand for electric vehicles (EVs), advances in the development of self-driving technology and the growing investment in smart manufacturing are the major reasons for this growth. The government’s push for sustainable mobility and initiatives like the Faster Adoption and Manufacturing of EVs (FAME) are accelerating the trend. The leading players like Tata Motors, Mahindra and Mahindra, and Maruti Suzuki are investing heavily in research and development and are forming strategic alliances to enhance their product offerings and market share. Tata Motors, for instance, has launched a range of EVs that cater to the growing eco-friendly segment of the market. It has also teamed up with technology companies to integrate advanced features in its vehicles.

Regional Market Size

Regional Deep Dive

The Indian automobile industry is experiencing rapid growth and transformation, mainly due to increasing urbanization, rising disposable incomes, and a growing middle class. The industry is also seeing a shift towards electric vehicles and sustainable mobility solutions, with government initiatives and investments from both domestic and international players. Competition is also intensifying, with established players and new entrants vying for market share. This is driving innovation in technology and manufacturing.

Europe

- European automotive giants such as Volkswagen and BMW are collaborating with Indian firms to develop electric and hybrid vehicles, reflecting a trend towards sustainable automotive solutions.

- The European Union's stringent regulations on carbon emissions are pushing Indian manufacturers to innovate and invest in cleaner technologies, which is expected to enhance their competitiveness in the global market.

Asia Pacific

- The Asia-Pacific region is witnessing a surge in demand for two-wheelers and electric vehicles, with companies like Hero MotoCorp and Bajaj Auto leading the charge in innovation and production.

- Government initiatives such as the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme are providing financial incentives for consumers and manufacturers, significantly impacting the growth of the EV segment.

Latin America

- Latin America presents a growing market for Indian automotive exports, with companies like Mahindra & Mahindra expanding their presence through local assembly plants.

- Economic factors, such as fluctuating currency rates and trade agreements, are shaping the strategies of Indian automotive firms as they navigate market entry and expansion.

North America

- The North American market is increasingly focusing on electric vehicle technology, with companies like Tesla and Ford investing heavily in EV production and infrastructure, which influences Indian manufacturers to adopt similar strategies.

- Regulatory changes in emissions standards are prompting Indian automotive companies to enhance their compliance measures, with organizations like the Society of Indian Automobile Manufacturers (SIAM) advocating for cleaner technologies.

Middle East And Africa

- The Middle East and Africa region is seeing increased interest from Indian automotive manufacturers looking to expand their footprint, with companies like Tata Motors establishing partnerships to tap into local markets.

- Cultural preferences for larger vehicles are influencing Indian manufacturers to adapt their offerings, focusing on SUVs and crossovers to meet regional demands.

Did You Know?

“India is projected to become the third-largest automotive market in the world by 2025, driven by a combination of domestic demand and export opportunities.” — Society of Indian Automobile Manufacturers (SIAM)

Segmental Market Size

The electric vehicle (EV) market in India is growing rapidly, driven by the increasing demand for sustainable transport solutions. The government’s FAME (Faster Adoption and Manufacturing of EVs) scheme, which aims to encourage the adoption of EVs by offering incentives, is another factor that is promoting the market. Moreover, consumers are becoming increasingly aware of the importance of protecting the environment. The growing availability of EVs and the development of new battery technology are also helping to promote the EV market. The EV adoption phase in India is now moving from the trial stage to the mass-production stage, with Tata Motors and Mahindra Electric leading the way. A number of states, such as Maharashtra and Delhi, are establishing a comprehensive charging system to support this shift. The main EV applications are in personal transportation, public transport, and last-mile delivery. In these fields, Ola and Ather Energy are making inroads. Moreover, macro-development trends, such as the push towards carbon-free mobility and the rapid urbanization of the country, are driving the market’s growth. The development of smart charging solutions and vehicle-to-grid (V2G) technology is also shaping the evolution of the EV market.

Future Outlook

The Indian automobile industry is expected to grow from INR 129,392 Crore in 2025 to INR 2,76,468 Crore in 2034, at a CAGR of 8.8 per cent. It will be driven by rising incomes, increasing urbanization and the rise of the middle class. The per capita vehicle ownership in the urban areas is expected to reach 300 per 1,000 by 2034 from 200 in 2025. This means that the demand for personal and commercial vehicles will be significantly higher. It will also be shaped by technology and policy initiatives. The Indian government’s support for electric vehicles through incentives and building the necessary charging stations will shift consumer preferences. By 2034, the electric vehicle market is expected to account for 30 per cent of the total vehicle market. The development of connected and self-driving vehicles will also increase the demand for these vehicles. The automobile industry will have to be flexible to accommodate these changes. To remain competitive, manufacturers will have to invest in R&D and meet the changing preferences of consumers. In the coming years, the Indian automobile industry is expected to grow significantly.

Leave a Comment