Urbanization and Population Growth

Urbanization and population growth are significant drivers of the India Ambulance Market. As urban areas expand, the demand for efficient emergency medical services becomes increasingly critical. The urban population in India is projected to reach 600 million by 2031, necessitating a robust ambulance infrastructure to cater to this growing demographic. The current ratio of ambulances to the urban population is approximately 1:1,000, indicating a pressing need for expansion. This urbanization trend is likely to lead to increased investments in ambulance services, with both government and private entities seeking to enhance their capabilities. Consequently, the India Ambulance Market is expected to grow in response to these demographic shifts, ensuring that emergency medical services are accessible to all urban residents.

Government Initiatives and Policy Support

Government initiatives play a crucial role in shaping the India Ambulance Market. The Indian government has implemented various policies aimed at improving emergency medical services, including the National Health Mission, which emphasizes the need for efficient ambulance services. Financial support and subsidies for ambulance procurement are also provided, encouraging private and public sector participation. As of January 2026, the government aims to increase the number of ambulances per capita, which currently stands at approximately 0.5 per 1,000 people. This initiative is expected to enhance accessibility to emergency medical care, thereby driving growth in the India Ambulance Market. Additionally, the establishment of dedicated emergency response systems is likely to further streamline operations and improve service delivery.

Growing Demand for Specialized Ambulances

The demand for specialized ambulances is on the rise within the India Ambulance Market. This trend is largely attributed to the increasing prevalence of chronic diseases and the need for tailored medical transport solutions. For example, neonatal and cardiac ambulances equipped with specialized medical equipment are becoming essential in urban areas. The market for these specialized vehicles is expected to expand significantly, with estimates suggesting a growth rate of around 12% annually. This surge is driven by the need for timely and appropriate medical care during transport, which is critical for patient outcomes. Consequently, manufacturers are focusing on developing ambulances that cater to specific medical needs, thereby enhancing the overall service quality in the India Ambulance Market.

Rising Awareness of Emergency Medical Services

There is a growing awareness of the importance of emergency medical services (EMS) among the Indian population, which is positively impacting the India Ambulance Market. Public campaigns and educational programs are increasingly highlighting the significance of timely medical intervention during emergencies. As a result, more individuals are recognizing the need for reliable ambulance services, leading to increased demand. The market is projected to witness a surge in service utilization, with estimates indicating a potential increase of 15% in ambulance calls over the next few years. This heightened awareness is prompting both private and public sectors to invest in expanding their ambulance fleets and improving service quality, thereby contributing to the overall growth of the India Ambulance Market.

Technological Advancements in Ambulance Services

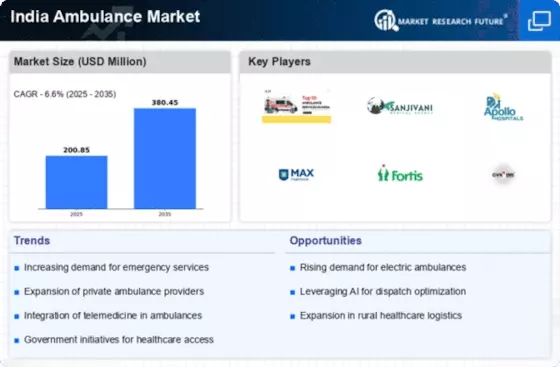

The India Ambulance Market is experiencing a notable transformation due to technological advancements. Innovations such as telemedicine integration, GPS tracking, and advanced medical equipment are enhancing the efficiency and effectiveness of ambulance services. For instance, the incorporation of real-time data analytics allows for better resource allocation and response times. The market is projected to grow at a CAGR of approximately 10% over the next five years, driven by these technological improvements. Furthermore, the adoption of electric and hybrid ambulances is gaining traction, aligning with India's sustainability goals. This shift not only reduces operational costs but also addresses environmental concerns, making the India Ambulance Market more resilient and future-ready.