Rising Aging Population

The Global Incontinence Devices and Ostomy Market Industry is experiencing growth driven by the increasing aging population worldwide. As individuals age, the prevalence of incontinence and the need for ostomy care tend to rise. In 2024, the market is valued at 16.2 USD Billion, reflecting the growing demand for effective management solutions. By 2035, this figure is projected to reach 24.5 USD Billion, indicating a significant market expansion. The aging demographic necessitates innovative products that cater to their specific needs, thus propelling the industry forward.

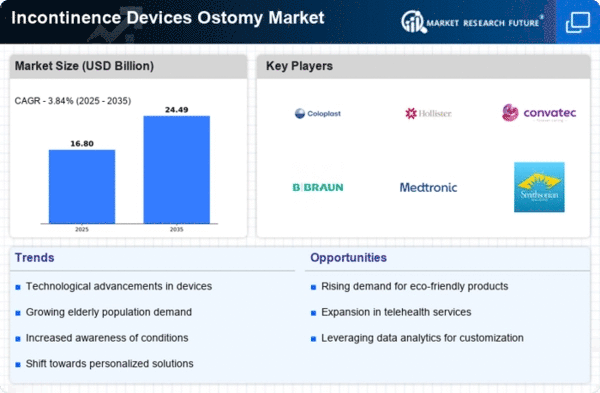

Market Growth Projections

The Global Incontinence Devices and Ostomy Market Industry is projected to experience substantial growth in the coming years. With a market value of 16.2 USD Billion in 2024, it is expected to reach 24.5 USD Billion by 2035. This growth trajectory indicates a robust demand for incontinence and ostomy products, driven by various factors such as an aging population and advancements in technology. The anticipated CAGR of 3.84% from 2025 to 2035 further highlights the industry's potential for expansion, as stakeholders continue to innovate and respond to the evolving needs of consumers.

Advancements in Technology

Technological advancements play a crucial role in shaping the Global Incontinence Devices and Ostomy Market Industry. Innovations such as smart sensors, improved materials, and user-friendly designs enhance product effectiveness and user comfort. For instance, the development of absorbent materials that provide better leakage protection and skin health has transformed product offerings. These advancements not only improve user experience but also contribute to market growth, as consumers increasingly seek high-quality solutions. The integration of technology into these devices is likely to attract a broader customer base, further driving market expansion.

Rising Healthcare Expenditure

The Global Incontinence Devices and Ostomy Market Industry benefits from the rising healthcare expenditure observed in many countries. Increased funding for healthcare services allows for better access to incontinence and ostomy products, which are essential for improving the quality of life for affected individuals. Governments and private sectors are investing in healthcare infrastructure, leading to enhanced availability of these devices. This trend is expected to support market growth, as higher healthcare spending correlates with increased demand for innovative and effective incontinence management solutions.

Increasing Awareness and Education

Raising awareness about incontinence and ostomy care significantly influences the Global Incontinence Devices and Ostomy Market Industry. Educational initiatives aimed at both healthcare professionals and patients help to destigmatize these conditions, encouraging individuals to seek appropriate care and products. As awareness grows, so does the demand for specialized devices that meet the unique needs of users. This trend is expected to contribute to the market's growth trajectory, as more individuals recognize the importance of managing their conditions effectively. Consequently, the industry is likely to see an increase in product adoption.

Growing Prevalence of Chronic Diseases

The prevalence of chronic diseases, such as diabetes and neurological disorders, is a significant driver of the Global Incontinence Devices and Ostomy Market Industry. These conditions often lead to incontinence and the need for ostomy care, thereby increasing the demand for related products. As the global population ages and chronic diseases become more common, the market is poised for growth. The projected CAGR of 3.84% from 2025 to 2035 underscores the potential for expansion in this sector, as healthcare providers seek to offer comprehensive solutions for managing these conditions.